Just one more thing on interest rates and inflation, I think we're going into a deflationary period after this supply chain related and base effect related bounce in inflation…Today's inflation numbers, I'm sure to many people, were shocking. Just looking through it, it seemed very much supply chain oriented. Car rental, transportation costs, and so forth. We think that the core CPI inflation will stay in the 3% to 4% range for the next few months, and PPI inflation headline could be anywhere from 6% to 10% on a year-over-year basis.

But I think we've never seen such serious supply chain issues as we're seeing now. Think about it. A year ago, the economy effectively just shut down. During '08, '09, it was shutting down. It was a slow move into that cathartic moment. This was just cold turkey. Businesses cut off all orders, and what happened was the consumer saving rate soared to 34%, 35% and the consumer had very few places to spend. Goods. Goods were the spaces to spend, right? Durables and non-durables, especially for the home and so forth. Well, that's where they spent a disproportionate amount of their budget relative to normal.

Goods are only one-third of consumption in the GDP accounts. Services are two-thirds. What I think is going to happen now is businesses are scrambling like crazy to keep up with demand. They can't. They got way behind. They're… double and triple and quadruple ordering. That's the first thing. The consumer, yes, has been spending aggressively on goods, but probably is about to shift the mix back towards services, maybe disproportionately. I think we're going to end up with a massive inventory problem towards the end of this year or into next year. We see three sources of deflation on the horizon. The first is that one, and that's inventory-driven and very commodities-oriented.

The second is what we call good deflation. Good deflation is associated with technologically-enabled innovation. Wright's Law is really important to us. It says for every cumulative doubling in the number of units produced, costs associated with technologically-enabled innovation decline at a consistent percentage rate.

Huge deflationary forces that are going to increase access as prices come down, and unit growth therefore will explode in those areas. The bad deflation is the corollary to that, and that is, we believe as much as 50% of the companies in the S&P 500 are going to be disintermediated or disrupted by the five innovation platforms around which we have centered our research: DNA sequencing, robotics, energy storage, artificial intelligence, and blockchain technology. They are in harm's way, and they probably, because they are more mature, since the tech and telecom bust and the '08, '09 meltdown, they have basically complied with short-term-oriented investor demands. They want profits, they want them now. They want dividends, they want them now.

To do so, companies leveraged up. Now many of them are going to be in harm's way. In order to service debt, they'll have to cut prices. We see major deflationary forces evolving here. I know on a day where the CPI has gone up 0.8 and then 0.9 in core, many people might be looking at this and wondering. But this is what we do all day long. We know the good deflationary forces are in place, we know the bad deflationary forces are in place, and now we believe, given what we're seeing with inventories, double, triple ordering, that there's another deflationary bias that's being built into the system, but probably won't play out until later this year, next year.

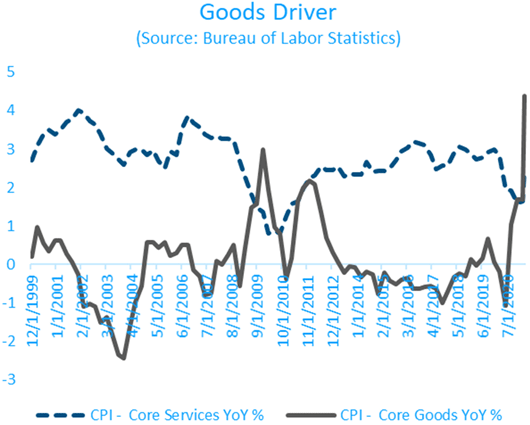

To Cathie’s point, much of the recent inflation is coming from “goods inflation.” Here’s a chart from Sam Rines on the year-over-year core services and core goods inflation. Notice the steep rise in core goods.