Men Without Work | Thoughts from the Frontline Investment Newsletter | Mauldin Economics

... The growing incapability of grown men to function as breadwinners cannot help but undermine the American family. It casts those who nature designed to be strong into the role of dependents – on their wives or girlfriends, on their aging parents, or on government welfare. Among those who should be most capable of shouldering the burdens of civic responsibilities, it instead encourages sloth, idleness, and vices perhaps more insidious....

...the some 20 million former felons who have been relegated to second-class workforce status...

...Maybe we need to rethink about how long felony convictions stay attached to personal records. When you can’t even rent an apartment in many states because you were a felon, and in some cases simply because you were charged with a felony at some time in the past, is it any wonder that we have large numbers of people not participating in the labor force?...

...Between 1948 and 2015, the work rate for U.S. men twenty and older fell from 85.8 percent to 68.2 percent.

Tuesday, March 28, 2017

Saturday, March 25, 2017

Tesla Will Take Orders for Its Solar Roof in April - Bloomberg

Tesla Will Take Orders for Its Solar Roof in April - Bloomberg

After Tesla acquired SolarCity in November, Musk said Tesla’s new solar roof product will actually cost less to manufacture and install than a traditional roof—even before savings from the power bill. “Electricity,” Musk said, “is just a bonus.”

Still, the solar tiles are likely to be a premium product: The terra cotta and slate roofs Tesla mimicked are among the most expensive roofing materials on the market—costing as much as 20 times more than cheap asphalt shingles.

Friday, March 24, 2017

Honeymoon's Over for Peer-to-Peer Lending - Bloomberg Gadfly

Honeymoon's Over for Peer-to-Peer Lending - Bloomberg Gadfly

...many larger financial institutions are trying to break into the computerized lending business. For example, SunTrust Bank has its LightStream platform and Goldman Sachs recently launched its Marcus online consumer lending system.

...many larger financial institutions are trying to break into the computerized lending business. For example, SunTrust Bank has its LightStream platform and Goldman Sachs recently launched its Marcus online consumer lending system.

These larger financial firms have the upper hand at this point. ...

Pension Crisis Too Big for Markets to Ignore - Bloomberg View

Pension Crisis Too Big for Markets to Ignore - Bloomberg View

In late 2006, Aaron Krowne, a computer scientist and mathematician, started a website that documented the real-time destruction of the subprime mortgage lending industry. The Mortgage Lender Implode-O-Meter caught on like wildfire with financial market voyeurs, regularly reaching 100,000 visitors. West Coast lenders, some may recall, were the first to fall in what eventually totaled 388 casualties.

A year earlier, to much less fanfare, Jack Dean launched another website in anticipation of the different kind of wave washing up on the California coastline. Called the Pension Tsunami, ...

...I started tracking this issue in 2004 after the Orange County Board of Supervisors gave a retroactive pension formula increase of 62 percent to county employees,” he said. “I was stunned. It’s the main reason Orange County has a $4.5 billion underfunded liability today.”

Rents in Megacities Can't Go Up Forever - Bloomberg View

Rents in Megacities Can't Go Up Forever - Bloomberg View

...Some activities, such as dentistry and cement production, don’t cluster geographically very much, for obvious reasons. In contrast, finance (New York and London), information technology (the Bay Area), and entertainment (Hollywood and New York) are the most clustered. For whatever reasons, it makes sense to have many of the top decision-makers in one place....

...looking forward, the supercreators of the next generation just aren’t that rich yet, and they may prefer to experiment with their new ideas in lower-rent environments, if only because that will make it easier to hire other people...

...Part of the vitality of the current megacities is that they have had cheaper areas on their fringes, such as Brooklyn in New York or Oakland or East Palo Alto in California, but increasingly those areas are cheap no more....

...The importance of the megacities is hardly going away. But neither do we face a future where the expense of living in these cities simply will rise without limit.

...Some activities, such as dentistry and cement production, don’t cluster geographically very much, for obvious reasons. In contrast, finance (New York and London), information technology (the Bay Area), and entertainment (Hollywood and New York) are the most clustered. For whatever reasons, it makes sense to have many of the top decision-makers in one place....

...looking forward, the supercreators of the next generation just aren’t that rich yet, and they may prefer to experiment with their new ideas in lower-rent environments, if only because that will make it easier to hire other people...

...Part of the vitality of the current megacities is that they have had cheaper areas on their fringes, such as Brooklyn in New York or Oakland or East Palo Alto in California, but increasingly those areas are cheap no more....

...The importance of the megacities is hardly going away. But neither do we face a future where the expense of living in these cities simply will rise without limit.

Monday, March 20, 2017

Rookie Currency Traders Are Causing Trouble at Crucial Moments - Bloomberg

Rookie Currency Traders Are Causing Trouble at Crucial Moments - Bloomberg

...The organization concluded that “less experienced” traders handicapped by a limited knowledge of which algorithms to use at that moment “amplified” the route....

...Younger, lower-paid employees make up a greater percentage of trading desks than they have in years.

...The organization concluded that “less experienced” traders handicapped by a limited knowledge of which algorithms to use at that moment “amplified” the route....

...Younger, lower-paid employees make up a greater percentage of trading desks than they have in years.

Part of banks’ broader effort to cut staff, boost electronic trading and lower costs following the global crisis, the “juniorization of Wall Street,” as some in the industry call it, has been particularly acute in the foreign-exchange market.

The Wonder Material That May Make Spray-On Solar Cells a Reality - Bloomberg

The Wonder Material That May Make Spray-On Solar Cells a Reality - Bloomberg

...Silicon solar cells have been around since the early days of the space program and now dominate the industry, ...[but] tremendous amounts of energy are needed to produce the silicon in solar cells...

...12.1 percent efficiency rating on a cell measuring 16 square centimeters. That’s the highest efficiency on a large-size perovskite solar cell to date, ....

...In September, ... scientists achieved an efficiency rating of 21.6 percent by adding rubidium to improve stability.

...Researchers ... in October their technology obtained a 20.3 percent efficiency, according to the Science website. The gain was achieved by stacking two perovskite cells to capture low-energy and high-energy light waves....

...“We expect to have a product that meets industry requirements by the end of 2017,” Frank Averdung, chief executive officer at Oxford PV said by email. “Adding some time for qualification, certification and production, our first product could be commercially available towards the end of 2018.”

...Silicon solar cells have been around since the early days of the space program and now dominate the industry, ...[but] tremendous amounts of energy are needed to produce the silicon in solar cells...

...12.1 percent efficiency rating on a cell measuring 16 square centimeters. That’s the highest efficiency on a large-size perovskite solar cell to date, ....

...In September, ... scientists achieved an efficiency rating of 21.6 percent by adding rubidium to improve stability.

...Researchers ... in October their technology obtained a 20.3 percent efficiency, according to the Science website. The gain was achieved by stacking two perovskite cells to capture low-energy and high-energy light waves....

...“We expect to have a product that meets industry requirements by the end of 2017,” Frank Averdung, chief executive officer at Oxford PV said by email. “Adding some time for qualification, certification and production, our first product could be commercially available towards the end of 2018.”

Challenges remain. For one, researchers must still come up with a way to ensure the material remains stable outdoors for long periods of time. Methods for painting the material on large surfaces must also be improved, said Masanori Iida, an official at the technology and design sector at Panasonic. “It is difficult to continuously make the coating even,” Iida said by email.

Others are more cautious about the commercial viability of this new solar technology. “It certainly is going to be more than five years and it could be never,”

How DNA Could One Day Rebuild Cell Phones - Bloomberg

How DNA Could One Day Rebuild Cell Phones - Bloomberg

Inside a Boston lab just a few miles away from MIT, a team of PhDs is building tools for a future where factories are powered by biology, not traditional manufacturing. The startup, Ginkgo Bioworks, currently helps clients design flavors and fragrances by modifying the DNA of microbes like yeast. Once the yeast have been tweaked to produce a particular scent as a byproduct, they can be brewed like beer and the smell can be extracted and bottled -- which reduces the client's need to depend on natural resources for ingredients. (video by: Alan Jeffries, Victoria Blackburne-Daniell, Drew Beebe) (Source: Bloomberg)

Say Hello to $3 Trillion in Forgotten Debt - Bloomberg

https://www.bloomberg.com/gadfly/articles/2017-03-20/say-hello-to-3-trillion-in-forgotten-debt

... $3 trillion in operating lease obligations, ... For non-financial companies, those obligations equate to more than one quarter of their long-term (on-balance sheet) debt....

... $3 trillion in operating lease obligations, ... For non-financial companies, those obligations equate to more than one quarter of their long-term (on-balance sheet) debt....

Operating leases are actually pretty similar to debt. They represent money companies will be obliged to cough up in future to rent things like planes, ships and retail floor space. But right now you won't find them on the balance sheet....

...From 2019, this will change. New accounting rules called IFRS 16 will force companies to include operating lease commitments as part of their reported debt and assets...

...this is going to make companies appear far more leveraged. Debt will increase compared to equity. At the same time, earnings before interest, taxation, depreciation and amortization may increase because leases will be depreciated, not expensed. Retailers can typically expect an Ebitda uplift of more than 40 percent, PwC found.

The impact on reported liabilities is likely to prove most significant though....

Wednesday, March 15, 2017

Comments on US Travel Restrictions Hurting the Globalization and Exporting of US Capital - Maudlin (Watson)

South-by-Southwest

...Net bookings to the US are down by 6.5% (excluding China)...

https://mail.google.com/mail/u/0/#inbox/15acda87f71a43e8

...Among other things, SXSW is a big meeting place for start-up companies and venture capital investors. A lot of deals get made here.

Many of the investors and entrepreneurs who are attending are from other countries. I’ve met people from as far away as Brazil, Israel, Indonesia, South Africa, and Greece....

Most of these small foreign businesses don’t want American customers. They have no interest in competing with US businesses; they’re focused on their own countries. They’re here only because they need money to get off the ground.

In other words, rather than importing stuff to the US, they want American investors to export their dollars.

This is exactly what we want. President Trump’s goal is to reduce US dependence on imports and promote US investment overseas—and SXSW and other events like it are where many such relationships begin.

There’s one problem, though: Getting here to make those connections is no longer easy for non-US citizens.

The international SXSW attendees are all talking about our new border controls.

And it’s not just the people. Bringing any kind of electronic device into the US is difficult too.

...Flight app Hopper released research earlier this month that showed flight search from international origins to the US has dropped 17% since Trump’s inauguration......Net bookings to the US are down by 6.5% (excluding China)...

https://mail.google.com/mail/u/0/#inbox/15acda87f71a43e8

Monday, March 13, 2017

SoFi's Loan Losses Pile Up as Even Wealthy Borrowers Default - Bloomberg

SoFi's Loan Losses Pile Up as Even Wealthy Borrowers Default - Bloomberg

Social Finance Inc.’s online borrowers are defaulting at higher rates than underwriters for one of its bond deals had expected,...

...The company started out refinancing student loans from graduates of top universities, and expanded into providing a broader range of services and products, from wealth management to insurance to mortgages, in some cases with partners....

...Non-bank startups arranged more than $36 billion of loans in 2015, mainly for consumers, up from $11 billion the year before...

Social Finance Inc.’s online borrowers are defaulting at higher rates than underwriters for one of its bond deals had expected,...

...The company started out refinancing student loans from graduates of top universities, and expanded into providing a broader range of services and products, from wealth management to insurance to mortgages, in some cases with partners....

...Non-bank startups arranged more than $36 billion of loans in 2015, mainly for consumers, up from $11 billion the year before...

To Take on Tesla, Sweden's NorthVolt Seeks $1 Billion Next Year - Bloomberg

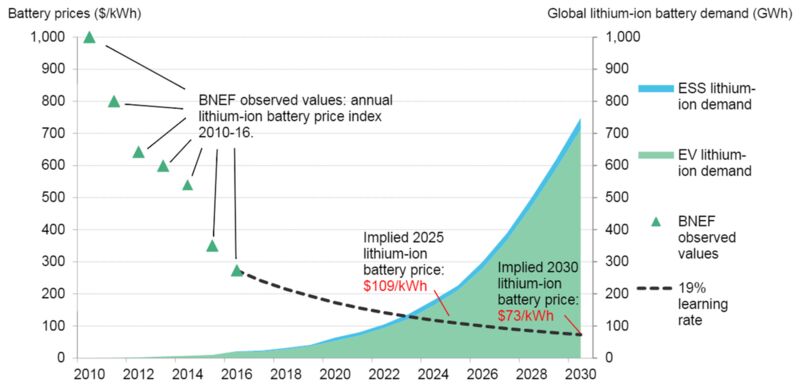

NorthVolt’s initial facility in Sweden is planned to have capacity to produce about 8 gigawatt-hours of batteries per year, rising to 32 gigawatt-hours once the project is fully operational in about six years. The company expects to lower to cost of lithium-ion battery packs significantly, aiming to halve prices by 2022, Carlsson said.

Battery Prices Falling

“The scale that NorthVolt is talking about could certainly bring down the cost of battery packs,” said Logan Goldie-Scot, energy storage analyst at BNEF. He’s still “skeptical” that NorthVolt will be able to raise the 4 billion euros it needs.

https://www.bloomberg.com/news/articles/2017-03-13/to-take-on-tesla-sweden-s-northvolt-seeks-1-billion-next-year

Sunday, March 12, 2017

Housing Bubble Déjà Vu - Project Syndicate (Mark Roe)

The 2008-2009 financial crisis exposed a serious weakness in the global financial system’s architecture: an overnight market for mortgage-backed securities that could not handle the implosion of a housing bubble. Some nine years later, that weakness has not been addressed adequately.

When the crisis erupted, companies and investors in the United States were lending their extra cash overnight to banks and other financial firms, which then had to repay the loans, plus interest, the following morning. Because bank deposit insurance covered only up to $100,000, those with millions to store often preferred the overnight market, using ultra-safe long-term US Treasury obligations as collateral.

But overnight lenders could command even higher interest rates if they took as collateral a less-safe mortgage pool, so many did just that. Soon, America’s red-hot housing market was operating as a multi-trillion dollar money market.

It soon became clear, however, that the asset pools underpinning these transactions were often unstable, because they comprised increasingly low-quality mortgages. By 2009, companies were in a panic. They balked at the idea of parking their cash overnight, with mortgage pools as collateral. This left the financial system, which had come to depend on that cash, frozen. Lending dried up, fear intensified, and the economy plunged into recession...

https://www.project-syndicate.org/commentary/us-housing-market-regulation-mortgage-pools-by-mark-roe-2017-03?utm_source=Project+Syndicate+Newsletter&utm_campaign=c22bb49d7a-the_sunday_newsletter_3_12_2017&utm_medium=email&utm_term=0_73bad5b7d8-c22bb49d7a-93854061#comments

Trade Truths for Trumpians and Brexiteers - Project Syndicate (Jim O'Neil)

...data on Germany’s total exports and imports in 2016 indicate that its largest trading partner is now China. France and the United States have been pushed into second and third place.

This news should not come as a surprise. I have often mused that, by 2020, German companies (and policymakers) might prefer a monetary union with China to one with France, given that German-Chinese trade would likely continue to grow.

...a country is likely to conduct more trade with big countries that have strong domestic demand, rather than with smaller countries that have weak demand.

...even if Brexit is not the UK’s biggest economic-policy challenge today, it will likely exacerbate other problems, including persistently low productivity growth, weak education and skills-training programs, and geographic inequalities.

https://www.project-syndicate.org/commentary/trade-truths-trump-brexit-by-jim-o-neill-2017-03?utm_source=Project+Syndicate+Newsletter&utm_campaign=c22bb49d7a-the_sunday_newsletter_3_12_2017&utm_medium=email&utm_term=0_73bad5b7d8-c22bb49d7a-93854061#comments

Some Start-Up Insights (from Catalant Blog by Eric Kleinman)

...successive approximation beats postponed perfection...

...Incubators also provide a fertile recycling ground. Startups that fail can have their assets repurposed, with people and technology being absorbed into other startups...

http://blog.gocatalant.com/incubators-how-corporations-can-access-innovation/

...Incubators also provide a fertile recycling ground. Startups that fail can have their assets repurposed, with people and technology being absorbed into other startups...

http://blog.gocatalant.com/incubators-how-corporations-can-access-innovation/

Wednesday, March 8, 2017

Northern Ireland Must Choose Stability Over Nationalism - Bloomberg View

Northern Ireland Must Choose Stability Over Nationalism - Bloomberg View

(Northern Ireland is the second largest recipient of EU funds by regional income)

(Northern Ireland is the second largest recipient of EU funds by regional income)

Tuesday, March 7, 2017

Monday, March 6, 2017

Rich Asian Millennials Pool Family Fortunes to Build Venture Fund

...they want to fill a gap in the region for the subsequent rounds of funding -- series B, C and D. “We want to play in that space because you get to cherry pick,” he said...

[On real estate]

...Ng recalls his grandfather, Singapore’s richest man when he died in 2010, would always visit a property he was interested in buying with his wife. After driving around the area, they would sit on a bench and observe it from a distance. Then they would return to the same spot after dark.

“He said to us, ‘What you see during the day can look very different at night,’” Ng said....

https://www.bloomberg.com/news/articles/2017-03-05/rich-gen-y-asian-kids-pool-family-fortunes-to-build-venture-fund

Sunday, March 5, 2017

Podcast - (early March 2017) - on Tech Companies, Amazon, Apple, Google, etc.

https://assets.bwbx.io/av/users/iqjWHBFdfxIU/vSoXWj.mQlWE/v2.mp3

Maudlin - on Jobs and Small Business Startups

...Because, at the end of the day, the data shows that net-net, new job creation comes from small business startups. That is, all of the net new job creation comes from small businesses less than five years old.

...large businesses, as a group, are not net creators of new jobs. They absolutely create new jobs at the front door, but at the back door they are ushering out old jobs...

...The jobs of the future are in new companies that have yet to be dreamed up. But they will all have to be found and financed.

...And every one of those new ventures and the half a million new businesses started every year requires capital. Every $%^&$&^% one of them. Blood and sweat and tears and lots of money. And that money has to come from somewhere.

...the data clearly shows that the more capital there is in a country, the more entrepreneurial capacity there is. And if you tax that capital too heavily, then you’re going to have less entrepreneurial activity. That is substantiated across countries and time in all of the research....

...the explosion of new businesses in China as capital becomes available?...

Please don’t give me this mumbo-jumbo BS about Federal Reserve interest rates and job growth. If you are starting a business, interest rates make damn little difference. You can’t borrow money from traditional sources anyway, except on your credit cards, which probably carry high interest rates. And maybe you can induce friends and a few other people to take less interest than that on their loans to you, which you have to guarantee. The businesses that are helped by lower interest rates are larger businesses that already have access to the credit window at their banks. But all the research – and I mean ALL the research – shows that large businesses are net destroyers of jobs. So maybe lower interest rates help them destroy fewer jobs, but low rates are not helping them create new jobs....

...the Republican leadership understands that cutting taxes and putting more money into the hands of potential entrepreneurs is the way to create jobs. ...

...That’s an entrepreneur. And when you tax them and regulate them and create all sorts of obstacles, you don’t get the new jobs they can create. That’s just a fact, Jack. You can live in your %*&^%*&^ ivory towers and point to data flows, and they don’t mean a thing because the data can tell you whatever you want it to tell you. The reality is, it all happens down on the front lines, where entrepreneurs wake up every morning trying to figure out how to make their businesses bigger, better, badder, meaner, leaner, faster. And they try to motivate their (often few) employees to sign on to the vision, for a paycheck – and, in a few cases, a piece of the future....

...In the words of Barry Switzer, one of the greatest football coaches of all time, “There’s only one most important thing. Don’t fumble the @%#$@# ball.” In 2017, the Republicans have the ball. Here’s hoping they don’t fumble it....

Future

...the storms that we all know are coming as the world struggles to figure out how to deal with the massive amounts of debt and government obligations that are building up. Maybe not this year, but at some point there has to be a great reset,..

http://www.mauldineconomics.com/frontlinethoughts/tax-reform-the-good-the-bad-and-the-really-ugly-part-four

Well, hooray! We are still creating 450,000 new businesses a year. Well, except. Except that we are losing more enterprises every year than we are creating. And we have been since the beginning of the Great Recession.

Part of the problem, as Tyler Cowen describes in his new book, The Complacent Class, is that Americans have seemingly lost some of their entrepreneurial drive. In the 1980s new startups accounted for some 12–13% of all businesses. Today it’s 7–8%. If we want to create an economy that is a jobs machine, we are going to have to have more business startups. Which means that we have to create a climate in which people feel comfortable in launching risky new ventures.

...large businesses, as a group, are not net creators of new jobs. They absolutely create new jobs at the front door, but at the back door they are ushering out old jobs...

...The jobs of the future are in new companies that have yet to be dreamed up. But they will all have to be found and financed.

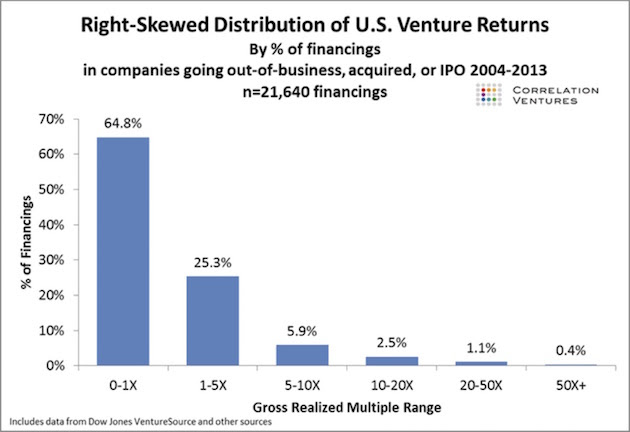

New-business creation is an extraordinarily risky business. Michael Gerber tells us that 80% of all new businesses fail or no longer exist in their original form within the first five years, and 80% of the remaining businesses no longer exist five years after that. The data from seasoned venture capital companies around the country more or less confirms these numbers. Here is a chart that I quickly found:

...And every one of those new ventures and the half a million new businesses started every year requires capital. Every $%^&$&^% one of them. Blood and sweat and tears and lots of money. And that money has to come from somewhere.

There are many politicians who think there is a new-jobs fairy. Just give the government more money, and it can create a “jobs program” that will create those new jobs.

Okay, now I’m going to be the guy who told your kids there is no Santa Claus.

There is no jobs fairy. Just call me Mr. Grinch.

All there is, seriously, is a dream factory where some person wakes up and decides they can create a brand-new future that leads to a better world and coincidentally some income for them. Or maybe the desire for income comes first. But then they have to figure out where to get the startup money. Business plans. Credit cards. Family and friends. If you’re connected and in Silicon Valley, maybe an introduction to Kleiner Perkins. And you’d better be damn good if you want to be one of the 5% they choose to back.

Most new businesses are more mundane than high-tech. Hairdressers, bars and restaurants, dry cleaners, and tons of franchise companies. Seriously, franchises are real businesses. For example, 82% of McDonald’s are owned by franchisees. They make between $500,000 and $1 million in profits per year. Various franchises account for over 8% of US jobs. All of the top 50 franchises are rather mundane local businesses – doughnut shops and hair salons and commercial cleaning outfits. Not exactly high-tech but solid jobs nonetheless. Seriously – go to Entrepreneur magazine’s Top 500 Franchise List if you have nothing else to do. Find me a high-tech, cutting-edge startup on the list that is going to be the next Google or Apple. But are these real businesses? Yes. Long-term moneymaking opportunities? Maybe. But costly to start up? Absolutely...

Problem:

...total US government spending – federal, state, and local – is more than 35% of the US economy, not including the increase in the national debt every year. Private business is less than twice the size of government and has to support all those government expenses....

...the data clearly shows that the more capital there is in a country, the more entrepreneurial capacity there is. And if you tax that capital too heavily, then you’re going to have less entrepreneurial activity. That is substantiated across countries and time in all of the research....

...the explosion of new businesses in China as capital becomes available?...

Please don’t give me this mumbo-jumbo BS about Federal Reserve interest rates and job growth. If you are starting a business, interest rates make damn little difference. You can’t borrow money from traditional sources anyway, except on your credit cards, which probably carry high interest rates. And maybe you can induce friends and a few other people to take less interest than that on their loans to you, which you have to guarantee. The businesses that are helped by lower interest rates are larger businesses that already have access to the credit window at their banks. But all the research – and I mean ALL the research – shows that large businesses are net destroyers of jobs. So maybe lower interest rates help them destroy fewer jobs, but low rates are not helping them create new jobs....

...the Republican leadership understands that cutting taxes and putting more money into the hands of potential entrepreneurs is the way to create jobs. ...

...That’s an entrepreneur. And when you tax them and regulate them and create all sorts of obstacles, you don’t get the new jobs they can create. That’s just a fact, Jack. You can live in your %*&^%*&^ ivory towers and point to data flows, and they don’t mean a thing because the data can tell you whatever you want it to tell you. The reality is, it all happens down on the front lines, where entrepreneurs wake up every morning trying to figure out how to make their businesses bigger, better, badder, meaner, leaner, faster. And they try to motivate their (often few) employees to sign on to the vision, for a paycheck – and, in a few cases, a piece of the future....

...In the words of Barry Switzer, one of the greatest football coaches of all time, “There’s only one most important thing. Don’t fumble the @%#$@# ball.” In 2017, the Republicans have the ball. Here’s hoping they don’t fumble it....

Future

...the storms that we all know are coming as the world struggles to figure out how to deal with the massive amounts of debt and government obligations that are building up. Maybe not this year, but at some point there has to be a great reset,..

http://www.mauldineconomics.com/frontlinethoughts/tax-reform-the-good-the-bad-and-the-really-ugly-part-four

Saturday, March 4, 2017

Tax Reform: The Good, the Bad, and the Really Ugly—Part Four (Maudlin)

http://www.mauldineconomics.com/frontlinethoughts/tax-reform-the-good-the-bad-and-the-really-ugly-part-four

...Let me pull a few random quotes from Nicholas Eberstadt’s powerful book Men Without Work. These are just a few of the almost 40 pages that I copied and made notes on from his 200-page book. I could literally write a whole letter just focusing on what I think are important quotes.

...Let me pull a few random quotes from Nicholas Eberstadt’s powerful book Men Without Work. These are just a few of the almost 40 pages that I copied and made notes on from his 200-page book. I could literally write a whole letter just focusing on what I think are important quotes.

The work rate has improved since 2014, but it would be unwise to exaggerate that turnaround. As of early 2016, our adult work rate was still at its lowest level in three decades. If our nation’s work rate today were back to its start-of-the-century highs, approximately 10 million more Americans would currently have paying jobs.

Here, then, is the underlying contradiction of economic life in America’s second Gilded Age: A period of what might at best be described as indifferent economic growth has somehow produced markedly more wealth for its wealth-holders and markedly less work for its workers. This paradox may help explain a number of otherwise perplexing features of our time, such as the steep drop in popular satisfaction with the direction of the country, the increasing attraction of extremist voices in electoral politics, and why overwhelming majorities continue to tell public opinion pollsters, year after year, that our ever-richer America is still stuck in a recession….

All of these assessments draw upon data on labor market dynamics: job openings, new hires, “quit ratios,” unemployment filings and the like. And all those data are informative—as far as they go. But they miss also something, a big something: the deterioration of work rates for American men…

Between 1948 and 2015, the work rate for U.S. men twenty and older fell from 85.8 percent to 68.2 percent. Thus the proportion of American men twenty and older without paid work more than doubled, from 14 percent to almost 32 percent. Granted, the work rate for adult men in 2015 was over a percentage point higher than 2010 (its all-time low). But purportedly “near full employment” conditions notwithstanding, the work rate for the twenty-plus male was more than a fifth lower in 2015 than in 1948.

....

The research shows that technology has net-net created far more jobs than it has destroyed. You can see this outcome in a wide variety of research over the years, but a recent study by Deloitte (as reported in the Guardian), which drew on data going back to 1871 in England and Wales, found that technology has been a job-creating machine. Part of that is because technology increases people’s spending power, which creates a surge in the demand for hairdressers, bar staff, etc.

Going back over past jobs figures paints a more balanced picture, say authors Ian Stewart, Debapratim De and Alex Cole.

“The dominant trend is of contracting employment in agriculture and manufacturing being more than offset by rapid growth in the caring, creative, technology and business services sectors,” they write.

5 Ways ‘Passive’ Investing Is Actually Quite Active - Bloomberg

https://www.bloomberg.com/view/articles/2017-03-03/5-ways-passive-investing-is-actually-quite-active

- Index Construction

- Portfolio Management You can tell how well passive managers play this game by using an underrated metric called “tracking difference,” which basically measures how far off an index fund or ETF is from its index’s return.

- Usage in Portfolios

- Engagement With Companies

- Above-Average Returns

Right now, index funds and ETFs via Vanguard and BlackRock own 12 percent of the stock market. (This number is expected to grow quickly, with 75 cents of every new dollar invested in the U.S. going into these two companies’ index-based products.)

Thursday, March 2, 2017

Watch U.S. Oil Drilling Collapse—and Rise Again - Bloomberg

... Raw rig counts are losing their predictive power. The drilling industry is increasingly automated, and wells are pumping oil faster. Gone are the abundant high-paying jobs in pop-up oil towns filled with roughnecks. The U.S. now produces 9 million barrels a day; when the shale boom first crossed that threshold in 2014, more than twice as many rigs were actively drilling.

https://www.bloomberg.com/graphics/2017-oil-rigs/

Wednesday, March 1, 2017

A Delivery Man Just Became One of the Richest People in China - Bloomberg

A Delivery Man Just Became One of the Richest People in China - Bloomberg

...Government support for the industry has also included encouraging Chinese package delivery companies to seek capital through equity markets—and approving their bids to raise money quickly, through backdoor listings that involve the companies taking over others, typically in unrelated fields, that are already publicly traded. So-called reverse mergers take a year or less to result in access to equity, while an IPO in China may take as long as three years, according to Sinolink’s Su. China’s current list of IPO seekers has 621 companies awaiting approval by the China Securities Regulatory.

...Now the courier operates a fleet of 36 cargo aircraft and about 15,000 vehicles. It reported revenue of 48.1 billion yuan in 2015, the highest among its domestic peers, according to its listing prospectus. It intends to build a cargo airport in the central Chinese province of Hubei, the prospectus said.

...Government support for the industry has also included encouraging Chinese package delivery companies to seek capital through equity markets—and approving their bids to raise money quickly, through backdoor listings that involve the companies taking over others, typically in unrelated fields, that are already publicly traded. So-called reverse mergers take a year or less to result in access to equity, while an IPO in China may take as long as three years, according to Sinolink’s Su. China’s current list of IPO seekers has 621 companies awaiting approval by the China Securities Regulatory.

...Now the courier operates a fleet of 36 cargo aircraft and about 15,000 vehicles. It reported revenue of 48.1 billion yuan in 2015, the highest among its domestic peers, according to its listing prospectus. It intends to build a cargo airport in the central Chinese province of Hubei, the prospectus said.

Subscribe to:

Posts (Atom)