Well, hooray! We are still creating 450,000 new businesses a year. Well, except. Except that we are losing more enterprises every year than we are creating. And we have been since the beginning of the Great Recession.

Part of the problem, as Tyler Cowen describes in his new book, The Complacent Class, is that Americans have seemingly lost some of their entrepreneurial drive. In the 1980s new startups accounted for some 12–13% of all businesses. Today it’s 7–8%. If we want to create an economy that is a jobs machine, we are going to have to have more business startups. Which means that we have to create a climate in which people feel comfortable in launching risky new ventures.

...large businesses, as a group, are not net creators of new jobs. They absolutely create new jobs at the front door, but at the back door they are ushering out old jobs...

...The jobs of the future are in new companies that have yet to be dreamed up. But they will all have to be found and financed.

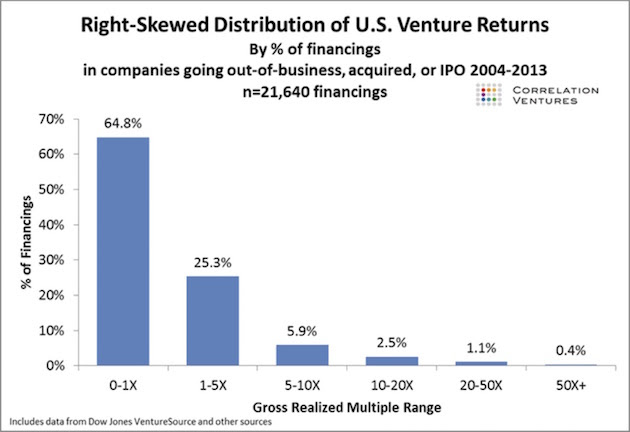

New-business creation is an extraordinarily risky business. Michael Gerber tells us that 80% of all new businesses fail or no longer exist in their original form within the first five years, and 80% of the remaining businesses no longer exist five years after that. The data from seasoned venture capital companies around the country more or less confirms these numbers. Here is a chart that I quickly found:

...And every one of those new ventures and the half a million new businesses started every year requires capital. Every $%^&$&^% one of them. Blood and sweat and tears and lots of money. And that money has to come from somewhere.

There are many politicians who think there is a new-jobs fairy. Just give the government more money, and it can create a “jobs program” that will create those new jobs.

Okay, now I’m going to be the guy who told your kids there is no Santa Claus.

There is no jobs fairy. Just call me Mr. Grinch.

All there is, seriously, is a dream factory where some person wakes up and decides they can create a brand-new future that leads to a better world and coincidentally some income for them. Or maybe the desire for income comes first. But then they have to figure out where to get the startup money. Business plans. Credit cards. Family and friends. If you’re connected and in Silicon Valley, maybe an introduction to Kleiner Perkins. And you’d better be damn good if you want to be one of the 5% they choose to back.

Most new businesses are more mundane than high-tech. Hairdressers, bars and restaurants, dry cleaners, and tons of franchise companies. Seriously, franchises are real businesses. For example, 82% of McDonald’s are owned by franchisees. They make between $500,000 and $1 million in profits per year. Various franchises account for over 8% of US jobs. All of the top 50 franchises are rather mundane local businesses – doughnut shops and hair salons and commercial cleaning outfits. Not exactly high-tech but solid jobs nonetheless. Seriously – go to Entrepreneur magazine’s Top 500 Franchise List if you have nothing else to do. Find me a high-tech, cutting-edge startup on the list that is going to be the next Google or Apple. But are these real businesses? Yes. Long-term moneymaking opportunities? Maybe. But costly to start up? Absolutely...

Problem:

...total US government spending – federal, state, and local – is more than 35% of the US economy, not including the increase in the national debt every year. Private business is less than twice the size of government and has to support all those government expenses....

...the data clearly shows that the more capital there is in a country, the more entrepreneurial capacity there is. And if you tax that capital too heavily, then you’re going to have less entrepreneurial activity. That is substantiated across countries and time in all of the research....

...the explosion of new businesses in China as capital becomes available?...

Please don’t give me this mumbo-jumbo BS about Federal Reserve interest rates and job growth. If you are starting a business, interest rates make damn little difference. You can’t borrow money from traditional sources anyway, except on your credit cards, which probably carry high interest rates. And maybe you can induce friends and a few other people to take less interest than that on their loans to you, which you have to guarantee. The businesses that are helped by lower interest rates are larger businesses that already have access to the credit window at their banks. But all the research – and I mean ALL the research – shows that large businesses are net destroyers of jobs. So maybe lower interest rates help them destroy fewer jobs, but low rates are not helping them create new jobs....

...the Republican leadership understands that cutting taxes and putting more money into the hands of potential entrepreneurs is the way to create jobs. ...

...That’s an entrepreneur. And when you tax them and regulate them and create all sorts of obstacles, you don’t get the new jobs they can create. That’s just a fact, Jack. You can live in your %*&^%*&^ ivory towers and point to data flows, and they don’t mean a thing because the data can tell you whatever you want it to tell you. The reality is, it all happens down on the front lines, where entrepreneurs wake up every morning trying to figure out how to make their businesses bigger, better, badder, meaner, leaner, faster. And they try to motivate their (often few) employees to sign on to the vision, for a paycheck – and, in a few cases, a piece of the future....

...In the words of Barry Switzer, one of the greatest football coaches of all time, “There’s only one most important thing. Don’t fumble the @%#$@# ball.” In 2017, the Republicans have the ball. Here’s hoping they don’t fumble it....

Future

...the storms that we all know are coming as the world struggles to figure out how to deal with the massive amounts of debt and government obligations that are building up. Maybe not this year, but at some point there has to be a great reset,..

http://www.mauldineconomics.com/frontlinethoughts/tax-reform-the-good-the-bad-and-the-really-ugly-part-four

No comments:

Post a Comment