| |||||||||||

| |||||||||||

Tuesday, February 22, 2022

Waymo by the bay - btbirkett@gmail.com - Gmail

Friday, February 18, 2022

Exclusive: The secret history of Pence’s Jan. 6 argument - btbirkett@gmail.com - Gmail

| |||

BY RYAN LIZZA | |||

| |||

| |||

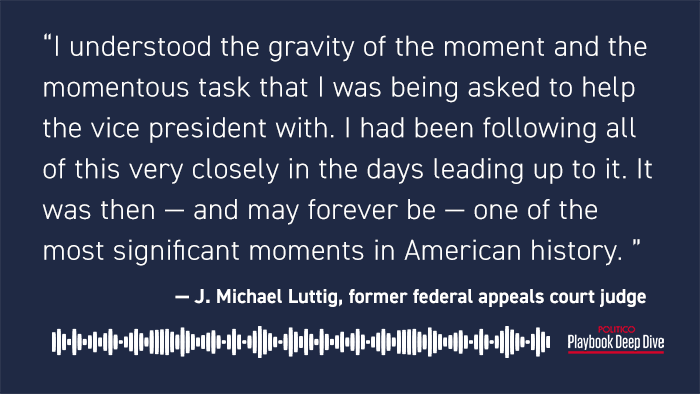

RUSSIA-UKRAINE LATEST —“Russia to stage nuclear drills with Ukraine tensions high,” by AP’s Vladimir Isachenkov, Yuras Karmanau and Darlene Superville in Kyiv — Meanwhile, President JOE BIDEN this afternoon will speak with the leaders of France, Germany, Italy, Poland, Romania, the U.K., the EU and NATO, per ABC News. THE PLAYBOOK INTERVIEW — On Wednesday, we spent three hours talking to one of the most influential conservative legal thinkers of his generation: J. MICHAEL LUTTIG. — As a staffer in the GEORGE H.W. BUSH White House, Luttig helped put CLARENCE THOMAS on the Supreme Court. — As a federal judge, he authored some of the most consequential decisions of the post-9/11 era, including a defense of the federal government’s authority to designate alleged terrorists as “enemy combatants.” — In 2005, he was the runner-up to be GEORGE W. BUSH’s choice to fill a vacancy on the Supreme Court. (DICK CHENEY favored him, HARRY REID threatened a filibuster, and Bush gave the job to Luttig’s good friend, JOHN ROBERTS.) More recently, Luttig played a key behind-the-scenes role during the Trump administration. He was considered as a possible FBI director, and strategized with his old friend BILL BARR when both men were considered as replacements for A.G. JEFF SESSIONS. In the end, Luttig never served DONALD TRUMP: His wife told him she would leave him if he did. Like a lot of conservatives, Luttig watched the Trump administration unfold with growing dismay. But he remained quiet. Then, Trump used the Electoral Count Act, an obscure 19th-century law, to try to convince then-VP MIKE PENCE that he had the ability to overturn their loss to JOE BIDEN and KAMALA HARRIS. The legal strategist behind Trump’s effort was well known to Luttig: JOHN EASTMAN was one of his many influential former law clerks. Eastman, despite his reputation now, was respected on the right. Pence needed someone with even more clout to convince conservatives that Eastman’s scheme was a crackpot idea. They needed Luttig. The full story of how Pence world recruited the former judge to provide the legal arguments for Pence’s actions on Jan. 6 is told here for the first time in the latest episode of our “Playbook Deep Dive” podcast. | |||

A message from Facebook: We’re making investments in safety and security—and seeing results | |||

Here’s a key excerpt, edited for clarity and length: Luttig: I was first called by the vice president’s outside counsel, RICHARD CULLEN, on the evening of Jan. 4. We now know that that was after the fateful Oval Office meeting that day between the president and vice president, where John Eastman made the argument that the vice president could overturn the election unilaterally as presiding officer. … He called the night of the 4th and says, “Hey Judge, what do you know about John Eastman?” And I said, “He was a clerk of mine 30 years ago.” He says, “Well, what else do you know?” I said, “I don’t know. John’s an academic, he’s a professor, he’s a constitutional scholar — and he’s a brilliant constitutional scholar.” … Richard said, “You don’t know, do you?” And I said, “Know what?” He said, “John’s advising the president and the vice president that the vice president has this authority [to reject electoral votes] on Jan. 6” — two days hence. And I said, “Wow, no, I did not know that. You can tell the vice president that I said that he has no such authority at all.” Richard said, “He knows that,” I said “OK,” and we hung up. … I got up the next morning … I’m having my coffee, and Richard calls — which is not unusual. But the call was unusual. He said, “Judge, can you help the vice president?” And I said, “Sure, what does he need?” He said, “Well, we don’t know what he needs.” And I said, “What do you mean you don’t know what he needs? Then why are you calling me?” He said, “Look, this is serious.” I said, “OK, I understand. What do you want?” He’s talking with MARC SHORT and the vice president. And he says, “We need to do something publicly, get your voice out to the country.” … Just try to put yourself in my position. I had not a clue [what to do]. … He called back … and I said, “Alright, I opened a Twitter account a couple of weeks ago, but I don't know how to use it.” He said, “Perfect.” And I said, “I told you: I don’t know how to use it.” He said, “Figure it out and get this done.” So I called my tech son, who works for PETER THIEL, and said, “How do I tweet something more than 180 characters long?” Ryan Lizza: Wait a second … The vice president is being pressured by the president of the United States to overturn the results of the election. And you’re the go-to legal mind who’s respected among Republicans that the vice president is looking to to essentially stop a coup. Do I have that right? Luttig: To answer the question you’re asking: I understood the gravity of the moment and the momentous task that I was being asked to help the vice president with. I had been following all of this very closely in the days leading up to it. It was then — and may forever be — one of the most significant moments in American history. I’m a cutup, but I’m deadly serious when the time comes, and that day, I was as serious as I can possibly be. Lizza: But first, you’ve got to learn how to tweet. Luttig: So my son says, “Dad, I don’t have time for this. You’ve got to learn this stuff on your own.” To which I said something like, “Just tell me right now how to get this done, or I’ll cut you out of the will.” … So I go down to my office, and I open up the [Twitter] instructions on my laptop and I copy and paste what I’ve written on my iPhone into my laptop … I read and reread it multiple times, and then I take a deep breath and I hit “tweet.” … Lizza: The vice president cited your legal analysis on Jan. 6 in his famous letter explaining what his responsibilities and authorities were that day. Luttig: Yes, that might be the greatest honor of my life. But it came to my attention in the least auspicious way. I got two back-to-back emails on [Jan.] 6 from two of my clerks … They said, “The vice president is on his way to the Capitol, and he cited you in his letter to the nation.” … That’s the first time that I ever knew what was to happen with the tweet from the day before. No one had ever told me that. … I was floored … The vice president called me the next morning to thank me . … And I said to the vice president that it was the highest honor of my life that he had asked me, and I will be grateful to him for the remainder of my life. Click here to listen to the full conversation, including details of Luttig’s latest legal crusade: convincing Republican senators to reform the Electoral Count Act so a repeat of Jan. 6 can never happen. TOP-ED — “Our Democracy Shouldn’t Rest on a Rickety Law,” by Sen. SUSAN COLLINS (R-Maine) writing about the Electoral Count Act in the NYT. Her concluding paragraph: “We do not know if we will succeed, but we are trying to fix a serious problem. The senators working on this legislation have philosophical, regional and political differences. When we disagree, we attempt to persuade one another — we cajole, haggle and even argue — but we do so with an eye on a common goal. That is the way it is supposed to work in a democracy. Maybe we could refer to the process as ‘legitimate political discourse.’” |

Thursday, February 17, 2022

London Wealth Manager Dolphin Collapse Draws Attention to U.K. Investor Visa - Bloomberg

The building

formerly housing Dolfin Financial offices on Berkeley Street in London.Source:

Google Street View

By

February 17, 2022, 1:00 AM GMT

Share this

article

The meeting above the

Virgin Active gym across the street from the Museum of London on Sept. 2 was

raucous and contentious even for a creditor gathering of a company gone bust.

Accountants

winding down U.K. wealth management firm Dolfin Financial faced more than 50 of its

affluent, angry Chinese clients shouting and hectoring them, many in Mandarin,

three people present at the meeting said. Dolfin had gotten them “golden visas”

for U.K. stays of about three-and-a-half years in exchange for investments,

using ways being questioned by the Financial Conduct Authority. Fearing their

visas could be revoked, they demanded documents proving the validity of their

investments.

For

Dolfin, the meeting was another ugly chapter in a saga that has brought about

its downfall. In March last year, the FCA barred it

from nearly all regulated activities, restrictions that pushed it into

administration. The regulator has been examining Dolfin’s practices since at

least 2019 over concerns about its visa business and potential conflicts of

interest.

Dolfin

used a complicated series of transactions that allowed wealthy Chinese clients

pay just 400,000 pounds ($542,000) for Tier-1 Investor Visas that by law

require an investment of at least 2 million pounds, according to an FCA supervisory notice.

The firm’s administrators told creditors on Jan. 28 that the FCA’s

investigation is ongoing. A spokeswoman for the regulator declined to

comment.

With the fate of the Chinese

investors in limbo, the Dolfin case once again drew attention to the U.K.’s

Tier-1 Investor Visas, showing how easily the system can be manipulated. For

years, as the program was mostly used by rich Russians and members of the the

ruling elites of former Soviet republics, campaigners protested that such visas

are a route for dirty money to enter the U.K.

Now, amid concerns about the

influence of Russian money, Britain is preparing to end the golden-visa regime,

a person familiar with the matter said on Wednesday.

Related News: U.K. Plans to Scrap Golden Visa Route for

Millionaire Investors

The U.K. has delivered at least

12,000 such visas since the system’s inception in 1994. About 6,000 are being

reviewed for national security risks, William Wallace, a lawmaker in the House

of Lords, said in parliament last week.

“We have imported corruption and

with it the danger that corrupt overseas wealth will in turn corrupt our own

society and democracy,” Wallace said as he pushed the government to publish its

audit of older visas.

Related Story: ‘Londongrad’ Undermines U.K.’s Tough Talk on

Russia Sanctions

For Dolfin, the visa service was

an exotic side businesses. Founded in 2013 by Denis Nagy and Roman Joukovski,

with offices a stone’s throw from the Ritz Hotel in central London, Dolfin

offered main-line financial services, including at one point providing advice

to ex-Goldman Sachs economist and British peer Jim O’Neill’s blind trust and

offering “discretionary” management services for clients with assets held by

Credit Suisse Group AG. The visa business, however, was its undoing.

The FCA in its supervisory notice

to Dolfin said the firm’s “visa business was so clearly unlikely to comply with

Tier 1 visa requirements that Dolfin would appear to have known, or at the very

least had reasonable cause to believe, that it was facilitating the commission

of a breach.”

Adam Stephens, a joint special

administrator for Dolfin, said he cannot comment on investigations into the

firm’s past business activities. Dolfin’s co-founders Nagy and Joukovski

declined to comment on the record on the FCA’s findings.

“Mr Joukovski and Mr Nagy had no

material involvement in the FCA investigation which gave rise to the

conclusions set out in the FCA Supervisory Notice,” a spokeswoman for them said

in an email. She said as far as the co-founders are aware, “the visa scheme was

in full compliance with all applicable laws and regulations.”

The Chinese investors who got

their visas through Dolfin say they believed the process was legitimate. The

Home Office is still scrutinizing their visas, but for now they can’t apply for

an extension or an indefinite leave to remain.

Dolfin marketed its visa services

to these clients offering five options code-named “Jade,” “Gold,” “Silver,”

“Platinum” and “Palladium” that used a convoluted set of transactions to secure

golden visas with less than the required amount of investment, the FCA

supervisory notice says.

Like

many firms catering to global elites, Dolfin drew in clients with an office

that exuded grandeur and legitimacy. It was in a building on Berkeley Street

that houses some of the biggest names in global investing, including hedge

funds Millennium Capital Partners and King Street Capital Management and private

equity titan Bain Capital. The

top-floor office Dolfin occupied until 2021 was impressive for a firm that lost

1.4 million pounds in 2019.

In a

slick video on YouTube entitled

“The future of finance today” a few years ago, Nagy went over the genesis of

the firm that had rapidly grown into a company with more than 100 employees.

Staffers made cameo appearances, talking about the “dynamic” environment, with

shots of views from the office over Mayfair stretching all the way to the

iconic BT Tower.

The glowing presentation belied

the often chaotic goings-on at the firm. Compliance was something of a

revolving door, according to former employees of the firm. Some said they were

horrified by the shortcuts management took in regulated activities, quitting

before their own reputations took a hit. The co-founders’ spokeswoman said

Dolfin’s operations were in line with FCA regulations.

In the visa business, Dolfin had

97 clients -- all from China and its semi-autonomous regions. Here’s how its

most-popular “gold” option worked, according to the FCA’s supervisory

notice:

First, the visa applicant gets a

family member to act as the owner and sole director of a special purpose

vehicle set up in an offshore jurisdiction like the British Virgin Islands. The

SPV then “borrows” 1.6 million pounds worth of bonds from a Dolfin-affiliated

company, which it then sells to another Dolfin-connected entity for 1.6 million

pounds. Next, the family member declares a dividend from the SPV of 1.6 million

pounds, sending it to the applicant’s account at Dolfin. The applicant then

pays 400,000 pounds into the account and asks Dolfin to invest the 2 million

pounds, which the wealth manager does through securities connected to family

members, directors, or other associates.

The transactions essentially

resulted in the applicant shelling out just 400,000 pounds for the visa. The

scheme was retrospectively signed off by immigration lawyers, but the FCA says

the lawyers weren’t told the whole story.

Dolfin isn’t the first firm to be

accused of gaming the system. Years ago, Maxwell Asset Management Ltd., another

facilitator of golden visas, had a process in which it loaned money to clients

with the proviso that the funds be invested in an entity called Eclectic

Capital Management. Eclectic, held by the wife of Maxwell’s owner Dimitri

Kirpichenko, plowed almost all that money into Russian companies rather than

U.K. ones, court documents show, defeating the purpose of the investment visas.

The Home Office rejected the

applications, arguing that Eclectic’s investments didn’t comply with the rules.

The decision was challenged by some investors and last year the Court of Appeal

accepted that the applications complied with the letter if not the spirit of

the law.

“I have not reached these

conclusions with any enthusiasm,” Judge Andrew Popplewell said, ruling that the

decision to deny Maxwell clients a visa was incorrect. “This result is,

however, a product of the drafting of the rules.”

The Home Office is asking the

U.K.’s highest court to look at the Maxwell case. Several attempts to reach

Maxwell and Eclectic for a comment were unsuccessful.

In the Dolfin case, the Home

Office hasn’t sent any letters of refusal yet, according to two people familiar

with the situation. Much as in the Maxwell case, the ultimate decision may lie

with a court. Some of Dolfin’s clients have hired Jackson & Lyon LLP, the

law firm used by the Maxwell visa applicants. The firm said it represents a

number of Dolfin’s Tier 1 investors and will determine the best course of

action if their visas are revoked.

The Home Office declined to

comment on the Dolfin case, but a spokeswoman said the department “will not

tolerate abuse of the system.”

Further complicating matters for

Dolfin, the FCA said in its supervisory notice that its broadened probe --

beyond visas -- found transactions suggesting an “unacceptable risk of the Firm

being used for the purposes of financial crime.”

It

revealed Dolfin’s “significant and ongoing connections” with an ultra-high net

worth client who had been subject to a U.K. Unexplained Wealth Order. The client is

Nurali Aliyev, the grandson of Kazakhstan’s long-time leader Nursultan

Nazarbayev, according to two people familiar with the matter. SourceMaterial

and openDemocracy revealed Aliyev’s identity as Dolfin’s mystery client last

month.

For many U.K. lawmakers, Aliyev’s

business in the country is emblematic of London’s role in the world of

financial crime.

“Britain has opened our borders,

our property market, our financial structures to the Kazakh ruling class

enabling them to launder their illicit wealth and to spend it,” lawmaker

Margaret Hodge said in Parliament this month, calling for Aliyev to be added to

the list of Kazakh elites under anti-corruption sanctions.

Bottom of Form

She

cited a Chatham House report showing that about 330 million pounds of U.K. real

estate belongs to the extended Nazarbayev family. Lawyers for Aliyev didn’t

respond to messages seeking comment, but in a 2020 case overturning a wealth order, Aliyev said

accusations against him and his family are “entirely without merit.” Dolfin’s

administrators and co-founders declined to comment on any business by the firm

with Aliyev.

Meanwhile,

some of Dolfin’s Chinese Tier-1 clients’ money appears to have been invested in

companies with links to the firm’s past and present directors. For example,

some of it was plowed into bonds issued by Artek Group Plc, a company owned by Nagy and

Joukovski’s wife, people familiar with the matter said. The spokeswoman for

Dolfin’s co-founders declined to comment on the investment.

Unlike Dolfin, Artek is still in

business. In fact, its office is on Berkeley Street, right across where Dolfin

used to be.

—

With assistance by Gina Turner, Luca Casiraghi, Jeremy Hodges, and Joe Mayes

Wednesday, February 16, 2022

Roman Glass

https://www.christies.com/features/Roman-Glass-Collecting-Guide-12077-1.aspx?sc_lang=en&cid=EM_EMLcontent04144B95Section_A_Story_5_0&COSID=40491755&cid=DM473991&bid=298641709