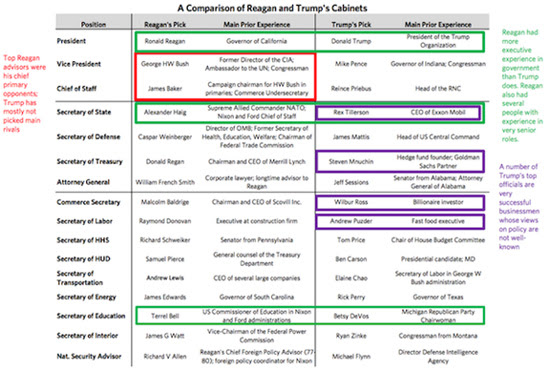

Dalio on Trump John Mauldin | Dec 21, 2016 I have never had the pleasure of meeting Ray Dalio, although I have talked with many people who work with him, and I make it a point to read everything he writes that I can get my hand on. (His outfit, Bridgewater Associates, is notoriously guarded about letting their writings out. I know for a fact that many folks at Bridgewater read my letter – which is admittedly free and certainly doesn’t come with the gravitas of running $150 billion – but in the spirit of the Christmas season I wonder if it wouldn’t be appropriate for them to share a little bit of the wealth.) That being said, Dalio did post a piece a couple days ago on LinkedIn that scratches the political itch that we all seem to have these days. It’s called “Reflections on the Trump Presidency, One Month after the Election”; and given the level of connections that Bridgewater management has and their often outside-the-box views, as well as the fact that this piece from Ray is a relatively positive one that seems appropriate before Christmas, I offer it up as this week’s Outside the Box. Dalio makes the point “This will not just be a shift in government policy, but also a shift in how government policy is pursued.” I am just back from a dinner meeting with a number of people in Washington who have some insight into the process, and I think I have to agree with that assessment. The interesting thing for us observers is going to be how a conservative House with seriously competing ideas as to how tax policy should be done works together with a Senate that has different views and with a Trump administration that has yet again different approaches. One thing I focused on here at the dinner was that there seems to be a consensus building in Congress to almost immediately repeal the Obamacare tax along with several other taxes and have that as one of the first bills on Trump’s desk. The reason for that move is that pretty much everyone agrees nothing will happen quickly, and it isn’t clear which taxes will be cut; but they want to do something to create stimulus as soon as possible, and then maybe even go back and change everything all over again next summer. These cuts will be ones that can be made quickly, and there were more than a few people in the room who are familiar with the congressional process and who think a final tax bill may not be out until later in the summer. And if you want some stimulus quickly, cutting taxes is a simple way to get it. That doesn’t mean the taxes won’t all get put back on in some form or another later on as they figure out what the overall tax picture will l look like; but for now it makes sense to get a quick tax cut to everyone. Frankly, I hope they deal with the corporate tax quickly, as there seems to be some bipartisan consensus on that. That would be better than trying to cobble together one huge omnibus tax bill. The dinner was hosted by the Committee to Unleash Prosperity. In general, much of the room was more optimistic about the potential for GDP growth in the coming years than I am. And they were not as concerned about dealing with the growing total debt of the US, although they did acknowledge that there is a very large contingent of deficit hawks in the Congress and Senate who are going to have their say on the budget and taxes. Those competing concerns – lowering taxes and dealing with the deficit and total debt – leave me distinctly unsure about what will eventually come out of the sausage factory that will create the new tax laws. But I don’t think there will be a quick resolution of the issues. It is somewhat ironic that we did my final tax planning today for 2016, but we really have no idea about planning for 2017 other than to assume that taxes want go down – and we hope that they do! I would love to be pleasantly surprised by a quick resolution on taxes so that we could all get on with business. And for those of you who simply can’t get enough politics these days (which sometimes sadly includes even me – though hopefully I will recover soon), let me suggest a quick read from my friend former Speaker of the House Newt Gingrich. It’s a collection of his essays on this last election cycle, simply called Electing Trump. You can get it for $3.99 on Amazon, and it is available only on Kindle. It really is a quick read – you can probably knock it out in less than 2 hours. As I’ve mentioned before, Newt has graciously engaged me in discussions on a wide ranged of topics in the past year, and our conversations have of course drifted to the political. He was consistently telling me since the fourth quarter of 2015 that Trump had a real chance. And he would patiently explain how frustrated so much of America was. I saw the frustration, but my political experience didn’t let me see how it would translate into a Trump victory. Now, hindsight shows that Newt was 100% on target, and he actually kept a sort of running diary of his comments and interviews, which is how this book could appear so fast. As Newt often says to me, “Real change requires real change.” Halfway measures are not going to make anybody happy. That’s where the rubber meets the road, because what is a good change for some people can be very upsetting to others. We will just have to see what emerges from the major process of change we’re embarked upon. Of course Newt’s book is partisan. As my kids would say, duh. But the political change he covers is part and parcel of a greater change that is happening. We’re near the end of Neil Howe’s Fourth Turning. I am reading a book that is probably going to be the subject of at least two letters early next year. It’s called Men Without Work. There are 10 million working-age men in America who are not participating in the labor force, and that trend line has been moving inexorably from the lower left to the upper right for 50 years, through Republican and Democratic administrations, through recessions and boom times. It wasn’t slowed down by the Clinton/Gingrich welfare reforms. The Greeks and the French have greater labor force participation rates than we do. And when you couple this worrisome trend with all of the other societal changes that are developing because of the increasing use of technology in the business arena, those of us w ho are trying to project macroeconomic outcomes are going to have to start paying much more attention to what’s going on sociologically on the ground. Is Dalio right? Will we see a lift in animal spirits beyond the Trump rally that morphs into actual businesses investing money in the creation of jobs? And will those jobs positively impact Middle America? The economic world is no longer simply defined by supply and demand but is increasingly under the sway of larger social and geopolitical movements. Trying to get a handle on all this is most confusing for a simple analyst like me. I should point out that my colleague Jared Dillian will have a somewhat different take on the same topic tomorrow in his 10th Man. His weekly essay is really beginning to get noticed all over the world, and deservedly so. I am really proud to be working with him and with all of my colleagues. (If you’re not receiving The 10th Man, you can sign up for it here, without cost.) There will be no letter from me this weekend, so let me wish you a Merry Christmas and a Happy New Year and holidays. And I want to thank you for the best gift of all, the gift of your attention and time. It is precious to me, and I continue to try to be worthy of it. Now, let’s have a great week and enjoy family and friends and a little good cheer. Your going into planning mode for 2017 analyst,  John Mauldin, Editor Outside the Box JohnMauldin@2000wave.com Reflections on the Trump Presidency, One Month after the ElectionBy Ray Dalio Originally published on LinkedIn, Dec. 19, 2016 Now that we’re a month past the election and most of the cabinet posts have been filled, it is increasingly obvious that we are about to experience a profound, president-led ideological shift that will have a big impact on both the US and the world. This will not just be a shift in government policy, but also a shift in how government policy is pursued. Trump is a deal maker who negotiates hard, and doesn’t mind getting banged around or banging others around. Similarly, the people he chose are bold and hell-bent on playing hardball to make big changes happen in economics and in foreign policy (as well as other areas such as education, environmental policies, etc.). They also have different temperaments and different views that will have to be resolved. Regarding economics, if you haven’t read Ayn Rand lately, I suggest that you do as her books pretty well capture the mindset. This new administration hates weak, unproductive, socialist people and policies, and it admires strong, can-do, profit makers. It wants to, and probably will, shift the environment from one that makes profit makers villains with limited power to one that makes them heroes with significant power. The shift from the past administration to this administration will probably be even more significant than the 1979-82 shift from the socialists to the capitalists in the UK, US, and Germany when Margaret Thatcher, Ronald Reagan, and Helmut Kohl came to power. To understand that ideological shift you also might read Thatcher’s “The Downing Street Years.” Or, you might reflect on China’s political/economic shift as marked by moving from “protecting the iron rice bowl” to believing that “it’s glorious to be rich.” This particular shift by the Trump administration could have a much bigger impact on the US economy than one would calculate on the basis of changes in tax and spending policies alone because it could ignite animal spirits and attract productive capital. Regarding igniting animal spirits, if this administration can spark a virtuous cycle in which people can make money, the move out of cash (that pays them virtually nothing) to risk-on investments could be huge. Regarding attracting capital, Trump’s policies can also have a big impact because businessmen and investors move very quickly away from inhospitable environments to hospitable environments. Remember how quickly money left and came back to places like Spain and Argentina? A pro-business US with its rule of law, political stability, property rights protections, and (soon to be) favorable corporate taxes offers a uniquely attractive environment for those who make money and/or have money. These policies will also have shocking negative impacts on certain sectors. Regarding foreign policy, we should expect the Trump administration to be comparably aggressive. Notably, even before assuming the presidency, Trump is questioning the one-China policy which is a shocking move. Policies pertaining to Iran, Mexico, and most other countries will probably also be aggressive. The question is whether this administration will be a) aggressive and thoughtful or b) aggressive and reckless. The interactions between Trump, his heavy-weight advisors, and them with each other will likely determine the answer to this question. For example, on the foreign policy front, what Trump, Flynn, Tillerson, and Mattis (and others) are individually and collectively like will probably determine how much the new administration’s policies will be a) aggressive and thoughtful versus b) aggressive and reckless. We are pretty sure that it won’t take long to find out. In the next section we look at some of the new appointees via some statistics to characterize what they’re like. Most notably, many of the people entering the new administration have held serious responsibilities that required pragmatism and sound judgment, with a notable skew toward businessmen. Perspective on the Ideology and Experience of the New Trump AdministrationWe can get a rough sense of the experience of the new Trump administration by adding up the years major appointees have spent in relevant leadership positions. The table below compares the executive/government experience of the Trump administration’s top eight officials* to previous administrations, counting elected positions, government roles with major administrative responsibilities, or time as C-suite corporate executives or equivalent at mid-size or large companies. Trump’s administration stands out for having by far the most business experience and a bit lower than average government experience (lower compared to recent presidents, and in line with Carter and Reagan). But the cumulative years of executive/government experience of his appointees are second-highest. Obviously, this is a very simple, imprecise measure, and there will be gray zones in exactly how you classify people, but it is indicative.  Below we show some rough quantitative measures of the ideological shift to the right we’re likely to see under Trump and the Republican Congress. First, we look at the economic ideology of the incoming US Congress. Trump’s views may differ in some important ways from the Congressional Republicans, but he’ll need Congressional support for many of his policies and he’s picking many of his nominees from the heart of the Republican Party. As the chart below shows, the Republican members of Congress have shifted significantly to the right on economic issues since Reagan; Democratic congressmen have shifted a bit to the left. The measure below is one-dimensional and not precise, but it captures the flavor of the shift. The measure was commissioned by a National Science Foundation grant and is meant to capture economic views with a focus on government intervention on the economy. They looked at each congressman’s voting record, compared it to a measure of what an archetypical liberal or conservative congressman would have done, and rated each member of Congress on a scale of -1 to 1 (with -1 corresponding to an archetypical liberal and +1 corresponding to an archetypical conservative).  When we look more specifically at the ideology of Trump’s cabinet nominees, we see the same shift to the right on economic issues. Below we compare the ideology of Trump’s cabinet nominees to those of prior administrations using the same methodology as described above for the cabinet members who have been in the legislature. By this measure, Trump’s administration is the most conservative in recent American history, but only slightly more conservative than the average Republican congressman. Keep in mind that we are only including members of the new administration who have voting records (which is a very small group of people so far).  While the Trump administration appears very right-leaning by the measures above, it’s worth keeping in mind that Trump’s stated ideology differs from traditional Republicans in a number of ways, most notably on issues related to free trade and protectionism. In addition, a number of key members of his team—such as Steven Mnuchin, Rex Tillerson, and Wilbur Ross—don’t have voting records and may not subscribe to the same brand of conservatism as many Republican congressmen. There’s a degree of difference in ideology and a level of uncertainty that these measures don’t convey. Comparing the Trump and Reagan AdministrationsThe above was a very rough quantitative look at Trump’s administration. To draw out some more nuances, below we zoom in on Trump’s particular appointees and compare them to those of the Reagan administration. Trump is still filling in his appointments, so the picture is still emerging and our observations are based on his key appointments so far. Looking closer, a few observations are worth noting. First, the overall quality of government experience in the Trump administration looks to be a bit less than Reagan’s, while the Trump team’s strong business experience stands out (in particular, the amount of business experience among top cabinet nominees). Even though Reagan’s administration had somewhat fewer years of government experience, the typical quality of that experience was somewhat higher, with more people who had served in senior government positions. Reagan himself had more political experience than Trump does, having served as the governor of California for eight years prior to taking office, and he also had people with significant past government experience in top posts (such as his VP, George HW Bush). By contrast, Trump’s appointees bring lots of high quality business leadership experience from roles that required pragmatism and judgment. Rex Tillerson’s time as head of a global oil company is a good example of high-level international business experience with clear relevance to his role as Secretary of State (to some extent reminiscent of Reagan’s second Secretary of State, George Shultz, who had a mix of past government experience and international business experience as the president of the construction firm Bechtel). Steven Mnuchin and Wilbur Ross have serious business credentials as well, not to mention Trump’s own experience. It’s also of note that Trump has leaned heavily on appointees with military experience to compensate for his lack of foreign policy experience (appointing three generals for Defense, National Security Advisor, and Homeland Security), while Reagan compensated for his weakness in that area with appointees from both military and civilian government backgrounds (Bush had been CIA head and UN ambassador, and Reagan’s first Secretary of State, Alexander Haig, was Supreme Allied Commander of NATO forces during the Cold War). Also, Trump has seemed less willing to make appointments from among his opponents than Reagan was (Reagan’s Chief of Staff had chaired opposing campaigns, and his Vice President had run against him).  By and large, deal-maker businessmen will be running the government. Their boldness will almost certainly make the next four years incredibly interesting and will keep us all on our toes. |

Saturday, December 24, 2016

Outside the Box - Dalio on Trump - 30 Days in.

Outside the Box - Dalio on Trump - btbirkett@gmail.com - Gmail

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment