Tuesday, August 29, 2017

Raising property taxes for public pensions

http://www.ocregister.com/2017/08/26/raising-property-taxes-for-public-pensions/

Monday, August 28, 2017

iGen: Why Today’s Super-Connected Kids Are Growing Up Less Rebellious, More Tolerant, Less Happy–and Completely Unprepared for Adulthood–and What That Means for the Rest of Us

iGen: Why Today’s Super-Connected Kids Are Growing Up Less Rebellious, More Tolerant, Less Happy–and Completely Unprepared for Adulthood–and What That Means for the Rest of Us

(link: https://www.amazon.com/exec/obidos/ASIN/1501151983).

It presents 10 trends that have shaped the first generation to grow up with smartphones:

(1) In No Hurry: Growing up slowly,

(2) Internet: Online time–oh, and other media, too,

(3) In Person No More,

(4) Insecure: The new mental health crisis,

(5) Irreligious,

(6) Insulated but not intrinsic: More safety and less community,

(7) Income Insecurity: Working to earn,

(8) Indefinite: Sex, marriage, and children,

(9) Inclusive: LGBT, gender, and race issues, and

(10) Independent:

Politics and civic involvement. iGen, born roughly 1995-2012, is sometimes called GenZ (but if Millennials are not GenY, GenZ won’t stick as a label). Shaped by smartphones, income inequality, and individualism, iGen’ers are noticeably different from their Millennial predecessors.

https://books.google.pt/books?id=50MyDwAAQBAJ&pg=PA343&lpg=PA343&dq=book+igen+university+of+chicago&source=bl&ots=prh5atHdiQ&sig=BSsDEOymPIMBNMHSHigQ7Vrfi_o&hl=en&sa=X#v=onepage&q=book%20igen%20university%20of%20chicago&f=false

(link: https://www.amazon.com/exec/obidos/ASIN/1501151983).

It presents 10 trends that have shaped the first generation to grow up with smartphones:

(1) In No Hurry: Growing up slowly,

(2) Internet: Online time–oh, and other media, too,

(3) In Person No More,

(4) Insecure: The new mental health crisis,

(5) Irreligious,

(6) Insulated but not intrinsic: More safety and less community,

(7) Income Insecurity: Working to earn,

(8) Indefinite: Sex, marriage, and children,

(9) Inclusive: LGBT, gender, and race issues, and

(10) Independent:

Politics and civic involvement. iGen, born roughly 1995-2012, is sometimes called GenZ (but if Millennials are not GenY, GenZ won’t stick as a label). Shaped by smartphones, income inequality, and individualism, iGen’ers are noticeably different from their Millennial predecessors.

https://books.google.pt/books?id=50MyDwAAQBAJ&pg=PA343&lpg=PA343&dq=book+igen+university+of+chicago&source=bl&ots=prh5atHdiQ&sig=BSsDEOymPIMBNMHSHigQ7Vrfi_o&hl=en&sa=X#v=onepage&q=book%20igen%20university%20of%20chicago&f=false

Saturday, August 26, 2017

Options Market Likes China’s Mobile-First Revolution

...Alibaba’s stock has doubled since Dec. 22, a day longer than it has taken Tencent’s shares to advance 80 percent. Baidu has climbed 30 percent since June 16.

While options prices indicate plenty of upside for Amazon, Facebook, Apple and Alphabet, the FAANGs have to overcome entrenchment in financial services, traditional retailing and in consumer attitudes. The BATs face lower hurdles, making the options market appear extremely optimistic about their potential. ...

https://www.bloomberg.com/view/articles/2017-08-25/options-market-likes-china-s-mobile-first-revolution

Too Much Debt Is Making Us Sticks-in-the-Mud - Bloomberg

Too Much Debt Is Making Us Sticks-in-the-Mud - Bloomberg

...But building owners who purchased their properties in recent years with the expectation that rents could only continue to rise may be in a bind. To secure financing, they would have to project a certain level of income, and if they accept less than that, they run the risk of being in default, or having their lender require them to put more equity into the building.

...But building owners who purchased their properties in recent years with the expectation that rents could only continue to rise may be in a bind. To secure financing, they would have to project a certain level of income, and if they accept less than that, they run the risk of being in default, or having their lender require them to put more equity into the building.

In other words, the landlords aren’t behaving irrationally; if it were an option, they would rather lease those spaces at a lower rent than collect nothing at all. But it's not an option, because if they sign those leases, they’ll trigger debt covenants that will cost them even more money than leaving the storefronts vacant.

...Most Americans now have a lot of debt, whether they’re ordinary workers or commercial landlords. Which means that most Americans have to be extraordinarily sensitive about letting their income cross the line where they can no longer support their debt payments. Which in turn means that already sticky prices may become positively glue-like.

Friday, August 25, 2017

Tuesday, August 22, 2017

The Morning Ledger: Finance Chiefs Look to Free Up Working Capital - btbirkett@gmail.com - Gmail

The Morning Ledger: Finance Chiefs Look to Free Up Working Capital - btbirkett@gmail.com - Gmail

...The 1,000 largest U.S. public companies reduced the number of days it took to convert working capital into cash received from customers to 35.7 days in 2016 from 37.1 a year earlier. European firms took 40.4 days, up from 39 days in 2015.

...The 1,000 largest U.S. public companies reduced the number of days it took to convert working capital into cash received from customers to 35.7 days in 2016 from 37.1 a year earlier. European firms took 40.4 days, up from 39 days in 2015.

Conagra Brands Inc. cut its cash conversion cycle by roughly 12 days during its 2017 fiscal year, resulting in a $263 million reduction in working capital. It improved expenditure usage in inventory, accounts receivable and accounts payable, said CFO David Marberger.

The focus on more efficient use of working capital follows a prolonged period of near-zero interest rates around the world. Credit is becoming more expensive as the Federal Reserve has started inching up interest rates in the U.S., and there are expectations of a less accommodative monetary policy from the European Central Bank. Hackett found that companies that cut their cash-conversion cycle by seven days added between 1.05% and 2.1% to their earnings margin.

Monday, August 21, 2017

U.S. Houses Are Using More Russian Lumber, Thanks to Canada Spat - Bloomberg

U.S. Houses Are Using More Russian Lumber, Thanks to Canada Spat - Bloomberg

The additional cost of Canadian lumber is not only saddling U.S. consumers with extra costs but threatens to price some of them out of the market, according to Howard. For every $1,000 price increase of a home, 150,000 people are priced out of the market, he said.

“Fewer houses are being built at the moderate price points, and they’re not being built because the cost of lumber puts them out of too much of the consumers’ buying range," he said.

...The dispute has increased material costs for house builders in the U.S. by 20 percent, ...

“Fewer houses are being built at the moderate price points, and they’re not being built because the cost of lumber puts them out of too much of the consumers’ buying range," he said.

Sunday, August 20, 2017

The Lost Lesson of the Financial Crisis (El Erian, Project Syndicate)

...A decade after the start of the crisis, advanced economies still have not decisively pivoted away from a growth model that is overly reliant on liquidity and leverage – first from private financial institutions, and then from central banks. They have yet to make sufficient investments in infrastructure, education, and human capital more generally. They have not addressed anti-growth distortions that undermine the efficacy of tax systems, financial intermediation, and trade. And they have failed to keep up with technology, taking advantage of the potential benefits of big data, machine learning, artificial intelligence, and new forms of mobility, while managing effectively the related risks.

https://www.project-syndicate.org/commentary/lost-lessons-of-the-financial-crisis-by-mohamed-a--el-erian-2017-08?utm_source=Project+Syndicate+Newsletter&utm_campaign=abbc1ef672-sunday_newsletter_20_8_2017&utm_medium=email&utm_term=0_73bad5b7d8-abbc1ef672-93854061

https://www.project-syndicate.org/commentary/lost-lessons-of-the-financial-crisis-by-mohamed-a--el-erian-2017-08?utm_source=Project+Syndicate+Newsletter&utm_campaign=abbc1ef672-sunday_newsletter_20_8_2017&utm_medium=email&utm_term=0_73bad5b7d8-abbc1ef672-93854061

Saturday, August 19, 2017

Outside the Box - Wages vs. Jobs - Gary Shilling (Maudlin)

Wages vs. Jobs

(Excerpted from the August 2017 edition of A. Gary Shilling's INSIGHT newsletter)

Real wages have been stagnant in the U.S. and other developed countries for over a decade. As we’ve discussed in numerous past Insights, this has made people “mad as hell” and has resulted in populist uprisings that spawned Brexit and the election of Donald Trump. Extremely aggressive monetary policy that reduced central bank-controlled interest rates to essentially zero did little to revive economic growth since creditworthy borrows already had plenty of money and banks, scared and chastened after the financial crisis, had little desire to lend to the rest.

Just Around the Corner

Yet, the Fed, first and foremost, but other major central banks as well remain convinced that rapid economic growth and surging labor costs are just around the corner, so they better tighten credit now to head off these threats of serious inflation. It appears that credit authorities believe the nation is in a typical 1950s-1960s business cycle and are not taking into account the many significant economic changes in recent decades. A number of these explains why labor markets are perplexing in the context of that earlier era, but quite rational in today’s climate.

Here are six major aspects of the current atmosphere.

1. Globalization. First and foremost is globalization, the shift of manufacturing and other production in the last three decades from developed countries in Europe and North America to developing economies in Asia, where costs are much lower. The resulting collapse in manufacturing employment in the West has been dramatic (Chart 1).

Furthermore, legal, accounting, medical billing and other services are being outsourced abroad, putting downward pressure on jobs and compensation in those sectors as well. A recent survey by Deloitte reveals the rapid rise in respondents’ plans to outsource many functions (Chart 2). As economies grow, a growing share of spending is on services and a declining portion on goods.

Note that with globalization, many U.S. goods prices continue to deflate. Meanwhile, domestic and international downward pressure is being felt on services as diverse as education, health care, retailing and financial service fees and commissions.

2. Ample worldwide men and machines also restrain U.S. wages and prices. Some policymakers fret that the output gap – the percentage of unutilized output in the U.S. economy – is shrinking fast (Chart 3). This is debatable since the economy’s output potential isn’t a fixed number but depends on speed of growth, which influences the economy’s flexibility. It can adapt much better to slow, predictable growth than to an unexpected surge in demand.

Also, capacity is sensitive to wages and prices. Higher pay attracts new workers who otherwise are comfortable drawing welfare, unemployment and disability benefits. By the same token, high selling prices can make otherwise obsolete machinery profitable to utilize.

On numerous tours of economic consulting clients’ factories, we’ve seen decades-old equipment next to state-of-the-art machines. The old machines are normally unprofitable to operate, but become so in times of high demand for their output and leaping prices. The current overall operating rate (Chart 4) remains below the levels that in the past have initiated capital spending surges, but even previous peaks would not indicate full capacity under the right economic circumstances.

More important, in today’s globalized world, supplies of labor and productivity capacity need to be considered on a worldwide basis, but data is woefully lacking, especially in rapidly-expanding developing economies. By all accounts, global supplies are ample and will remain so, barring all-out protectionist wars and tariff walls in advanced countries that could drastically chop imports.

Like Japan before her, China is moving up the scale of manufacturing sophistication while low-end output is shifting to lower-cost venues such as Vietnam, Pakistan, Indonesia and our long-term favorite, India, which is already robust in technological services exports.

With her rising population growth, democratic government, large privately-owned companies, the English language and a legal system inherited from the British, India seems destined to best China in economic growth and power in the long run, as we have discussed in past Insights. Prime Minister Narendra Modi’s efforts to reduce widespread corruption, oversized subsidies for the rural poor, and excessive government regulations are all encouraging.

3. U.S. labor surpluses. Back in December 2012, the headline unemployment rate was 7.7% and the Fed stated that the federal funds rate, then in the 0-¼% range, would be “appropriate at least as long as the unemployment rate remains above 6.5%, inflation one and two years ahead is projected to be no more than a half percentage point above the [policy] Committee’s 2% long run goal and long-term inflation expectations continue to be well anchored.”

U-3 is a well-known measure of labor market conditions and that's probably why the Fed picked it, but it's a very poor indicator of labor market slack or tightness. It is the ratio of those actively looking for work to that group plus the people who are employed.

Consequently, the unemployment rate declines if more are employed but it also falls if fewer are looking for jobs. The latter has dominated in recent years, as shown by the big drop in the labor participation rate, the percentage of all Americans over age 16 who are employed or actively seeking jobs (Chart 5). It peaked at 67.3% in early 2000 and fell to 62.4% in September 2015.

As reported in past Insights, our analysis revealed that about 60% of that decline was due to retiring postwar babies. The remaining 40%, however, was composed of those under 35 years old who stayed in school in the hope that more education would improve their job prospects in the weak job atmosphere initiated by the 2007-2009 Great Recession, and those 35-to-64 who gave up looking for work in a tough employment climate.

Furthermore, the labor participation rate earlier was driven up by women entering the job market, but by the early 2000s, they joined men in reducing their involvement. Further postwar baby retirements in future years will cut participation rates even more.

Without the precipitous drop in the labor participation rate, the headline unemployment rate, now at 4.4%, would be in double digits. The Fed, of course, was forced to abandon its 6.5% unemployment rate target for raising interest rates as U-3 fell and pierced that level in April 2014 when it fell to 6.2%. And U-3 continues to be a poor measure of slack in the labor market for several reasons.

Poor Measure

To begin, our analysis shows the growth in the working-age population will provide ample people to fill further available jobs, even if economic growth jumps from the economic recovery average of 2.1% to our forecast 3% to 3.5% – assuming they have the needed skills.

In addition, many of those who dropped out have not disappeared but may well be drawn back to work for expanding job opportunities. Indeed, the labor force of those age 20-to-29 has been growing since 2012 (Chart 6).

At the same time, people over 65 who are employed or actively looking has been rising since the early 1990s. Many seniors remain in good health and prefer active work to vegetating in front of the TV. Others, among them many postwar babies born in the 1946-1964 years, have been notoriously poor savers throughout their lives and need to keep working due to lack of retirement assets.

As a result of these developments on the young and old ends of the age spectrum, the total labor participation rate appears to have bottomed out. From September 2015 to this June, it rose from 62.4% to 62.8%.

Also, keep in mind that, like capacity utilization data, measures of labor market slack on a global basis aren't available. It certainly appears, however, to be ample, and the skills of workers in Asia are rising rapidly, not only in the production of goods but in services as well.

4. Cost-Cutting. The Fed was, no doubt, aware that after the Great Recession, U.S. corporate cost-cutting propelled earnings in lieu of significant unit volume growth and with negative pricing power. Since most business costs, directly or indirectly, are for labor, those actions axed employee compensation’s share of national income while profits’ share leaped (Chart 7).

In the last several years, however, those share movements have reversed. Whether that’s due to exhausting cost-cutting or picking all the low-hanging fruit while waiting for more to ripen remains to be seen, but compensation’s rising share of national income probably has gotten the central bank’s attention.

5. Shift to lower-paid jobs. Another wage-restraining force in this economic recovery is the job-creation emphasis on low-paid U.S. jobs, as we’ve explored in past reports. It’s been in low-paid sectors such as retail trade where many more people have gained jobs since the depths of the Great Recession, while real wages in retailing have risen just 0.9% in total since the beginning of 2007.

Similarly, the 3.0 million rise in hotel clerks, waiters and other leisure & hospitality jobs in this business recovery has far outstripped the 900,000 gain in manufacturing. In June, manufacturing employees were paid $26.51 per hour, 1.72 times the $15.43 per hour earned by leisure and hospitality workers. In addition, manufacturing employees worked 1.56 times as many hours, so their weekly pay, $1,081.61, was 2.69 times the $402.72 paid to the average leisure and hospitality employee. So the effect of differing sector employment growth has been to retard average wages.

The robust demand for low-skilled, low-paid workers is pushing up their wages as is the proliferation of minimum wage increases in many states and cities. But at the same time, pay increases of those in the 90th percentile are slowing (Chart 8). Nevertheless, so far in this expansion, workers in the 90th percentile have received 20% pay increases while those in the bottom 10th percentile have gained 12.5%, not enough to offset inflation.

Even within industrial sectors, wages have been depressed as postwar babies at the top of their pay scales retire and are replaced by lower-paid new recruits. In contrast, during the Great Recession, layoffs were centered in lower-paid people, many of whom were nice to have around in the previous good times, but not necessary when business declined. That elevated average wages.

More recently, however, new hires have come in at the low end of pay raises, depressing average pay. Furthermore, more so than in past recessions, part-time workers have moved to full-time jobs and 80% of them do so at below-median wages, according to a study by the San Francisco Federal Reserve.

This is especially true for those working part-time “for economic reasons,” i.e., those who want to work more hours than they are offered (Chart 9). This, too, pulls down overall median compensation. Also, 79% of those who have gained full-time jobs but were previously not in the labor force got below-median pay. Ditto for 72% of those previously unemployed when they got jobs.

As a result of these pay differences, the Atlanta Fed’s Wage Tracker series, which measures the wages of continuously full-time employees, has recovered more sharply than other earnings series, even the Employment Cost Index that corrects for employment shifts among industries (Chart 10).

This is a phenomenon similar to the ongoing income polarization discussed earlier. In any event, the fact that those with continuing full-time jobs have fared better than the rest doesn’t mitigate the depressing effect of consumer purchasing power on overall slow wage growth.

6. Union membership. With globalization devastating U.S. manufacturing jobs and cost-cutting pressure on those that remained, union membership in the private sector has collapsed from a quarter of the total workforce in 1973 to 6.4% last year.

This has had tremendous depressing effects on wages since private union jobs pay 19% more, on average, than non-union positions in base pay and over 50% more when health care, retirement and other benefits are included.

State and local government employees have enjoyed much higher pay and even more lush benefits than private sector workers. Nevertheless, municipal employee compensation is under fire from the many states and local governments with strained budgets and vastly-underfunded pension plans. At the same time, municipal union membership is slipping.

Quiescent Labor, Aggressive Management

Despite their lack of purchasing power growth, many employees are reluctant to demand higher pay. Memories of joblessness in the Great Recession are still fresh, as is the understanding that those who quit in the hope of getting a higher-paying job will probably end up with lower pay.

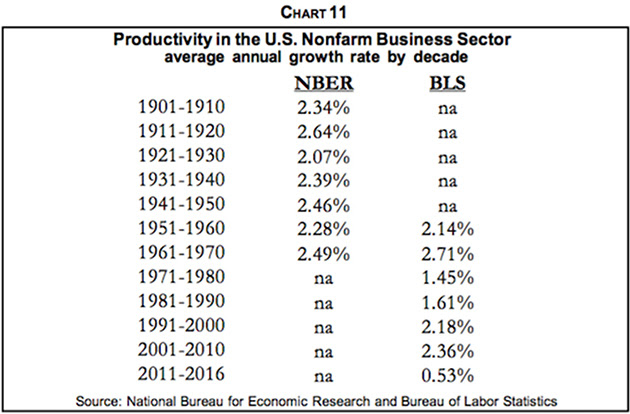

On the other side, most employers, in the face of excruciating foreign and domestic competition, don’t believe they can pass on increased labor costs through selling price hikes. The only alternative is increased productivity, which makes it possible to pay higher wages without cutting into business profits. To put it another way, the value added of any factor of production, including labor, must exceed its costs. And the miserable productivity growth in recent years (Chart 11) has not provided the value added to justify higher wages.

7. Productivity. The definition of productivity is simple. It’s the physical output in relation to all required inputs. It’s the measurement that’s tough. You can measure the widgets stamped out per hour on a punch press, but how do you determine the output of a cell phone?

Furthermore, the number of hours worked is straightforward, but the quality of the work by different employees is problematic. Also, other inputs such as capital, technical expertise and managerial talent are hard to measure. Consequently, the usual but unsatisfactory measure of productivity is output per hour worked.

By this measure, productivity growth averaging 0.53% per year in the 2011-2016 period has been far below the earlier norm of 2% to 2½%. The reasons for the slowdown are unclear, but many possibilities are being discussed that suggest that productivity growth is being significantly understated.

Measurement of Output

Cell phones and other high tech gear probably enhance efficiency of doing business far beyond their cost. Consider the value of time saved by shopping online, which is not captured in the statistics. The costs of new wonder drugs, high as they are, probably do not measure their value in saving lives.

Another explanation for slow U.S. productivity growth as officially reported is that much of it is hidden overseas. In order to avoid paying U.S. taxes, American multinationals have moved intangible assets overseas. Estimates are that between 2004 and 2008, these actions slowed U.S. reported productivity gains by 0.25 percentage points per year.

Delays

We’ve discussed in many past Insights that productivity-soaked new technologies mushroom but often take decades before becoming big enough to raise the overall productivity needle.

The Industrial Revolution began in England and New England in the late 1700s, but only after the 1860-1865 Civil War had it expanded to the point of hyping nationwide productivity. As a result, between 1869 and 1898, real GDP leaped by 4.32% per year (Chart 12) and output per capita leaped at a 2.11% annual rate. In contrast, it’s now rising around 1% annually (Chart 13).

We continue to believe that many of today’s new technologies such as biotech, robotics, cell phones, computers and self-driving vehicles are still in their infancy. In time, however, they should expand to the point that their rapid productivity advances propel overall productivity and economic growth.

That’s a big reason we expect a return to 3% to 3.5% real economic growth in the years ahead, especially as overall demand is driven by fiscal stimuli.

CapEx and Productivity

Many believe that the lack of significant productivity growth in recent years is due to sluggish capital spending, and they attribute that to excessive government regulations, business uncertainty over global developments and lack of clear policies in Washington.

Our research, however, indicates that the greatest driver of plant and equipment spending is operating rates. When they’re high, capacity is strained and more is needed to fulfill orders. When they’re low, as in recent years, there’s little need for more capital spending beyond that aimed at cutting costs and improving efficiency. We found other forces have only small influences on plant and equipment outlays, including corporate profits, cash flow and the growth rates of capacity utilization.

Improved productivity may be embedded in new plant and equipment, but there’s little evidence that big increases in capital expenditures result in surges in productivity. Chart 14 shows the growth rates of the two, and it’s clear that there is little correlation between the change in capital expenditures and the change in productivity. The correlation has an R2 of just 0.8% on a quarter vs. same quarter basis. Leading and lagging data don’t help much later. It shows that a productivity rise now promotes capital spending four quarters later, the reverse of what you’d expect, and that R2 is still a small 31.5%.

Productivity Outlook

Our conclusion is that rapid productivity and, therefore, the wherewithal to increase real wages will revive with the resumption of rapid economic growth in several years, the result of massive fiscal stimuli as well as the maturation of today’s new technologies. Other forces may well push in the same direction.

They include significant tax reform, significant government deregulation (but don't hold your breath; every president since Jimmy Carter has attempted to reduce the financial costs of regulations, but with little success), education reform, unifying licensing requirements, which often vary widely by state, to improve labor mobility and reforming disability, Social Security and other programs that can encourage people not to work.

Also, there’s nothing like a stronger economy to create labor demand and the resulting high employment and wages. As noted earlier, we foresee this in several years as a result of massive fiscal stimuli, spurred by voters “mad as hell” over weak purchasing power for over a decade.

Wednesday, August 16, 2017

Gartner Identifies Three Megatrends That Will Drive Digital Business Into the Next Decade

Gartner Identifies Three Megatrends That Will Drive Digital Business Into the Next Decade

...three distinct megatrends that will enable businesses to survive and thrive in the digital economy over the next five to 10 years.

...three distinct megatrends that will enable businesses to survive and thrive in the digital economy over the next five to 10 years.

Artificial intelligence (AI) everywhere, transparently immersive experiences and digital platforms are the trends that will provide unrivaled intelligence, create profoundly new experiences and offer platforms that allow organizations to connect with new business ecosystems....

The Energy Revolution Will Be Optimized - Bloomberg

The Energy Revolution Will Be Optimized - Bloomberg

...Each U.S. household consumes, on average, 9 percent less electricity now than in 2007, according to the Energy Information Administration. And as Nathaniel Bullard of Bloomberg New Energy Finance has pointed out, while the computing power of data centers has spiraled up in the past decade, their collective electricity consumption has climbed by just 7.5 percent. Over the same period, meanwhile, the average fuel economy of new vehicles has risen by roughly 25 percent, according to the University of Michigan's Transportation Research Institute....

...Each U.S. household consumes, on average, 9 percent less electricity now than in 2007, according to the Energy Information Administration. And as Nathaniel Bullard of Bloomberg New Energy Finance has pointed out, while the computing power of data centers has spiraled up in the past decade, their collective electricity consumption has climbed by just 7.5 percent. Over the same period, meanwhile, the average fuel economy of new vehicles has risen by roughly 25 percent, according to the University of Michigan's Transportation Research Institute....

Tuesday, August 15, 2017

Irving Wladawsky-Berger: Global Arbitrage and the Productivity Puzzle

Irving Wladawsky-Berger: Global Arbitrage and the Productivity Puzzle

comment:

One flaw would appear to be the idea of "compulsion", as a US company might be compelled, as Obama tried with restrictions and penalties on inversions; but the US company eventually has to compete with the 'non-compelled' companies headquartered in other countries for production and R&D.

As such, I'd also posit that an emphasis on supporting corporate and entrepreneurial startups and education, which are almost anathema to the compelled philosophy with accompanying regulatory zeal, are showing that jobs can be created when individuals are empowered and a focus is on 'opportunity' versus 'outcome'.

'Outcome' based programs obviously feed directly into emotional drivers of entitlement, which blame others and disincentivize.

If there are 6 million, ostensibly well-compensated, cross-class jobs going unfilled in the US, these facts alone would seem to argue that the incentives and support for education and training have been mis-directed and the funds appropriated by other entitled classes in society (here I might suggest that 2 places to look are those using government tax monies, which could otherwise be used for education and training but are going for eldercare and public pensions).

There are clearly no easy solutions as current-consumption (including at a government and social level) makes investments in future technologies more difficult.

It is also clear that some low-tech jobs may need to be socially supported as either long-term job and careers and as entry ladders for many people. Notwithstanding, the emphasis should be on helping people opportunistically participate in the higher skilled and better compensated parts of the economy.

comment:

One flaw would appear to be the idea of "compulsion", as a US company might be compelled, as Obama tried with restrictions and penalties on inversions; but the US company eventually has to compete with the 'non-compelled' companies headquartered in other countries for production and R&D.

As such, I'd also posit that an emphasis on supporting corporate and entrepreneurial startups and education, which are almost anathema to the compelled philosophy with accompanying regulatory zeal, are showing that jobs can be created when individuals are empowered and a focus is on 'opportunity' versus 'outcome'.

'Outcome' based programs obviously feed directly into emotional drivers of entitlement, which blame others and disincentivize.

If there are 6 million, ostensibly well-compensated, cross-class jobs going unfilled in the US, these facts alone would seem to argue that the incentives and support for education and training have been mis-directed and the funds appropriated by other entitled classes in society (here I might suggest that 2 places to look are those using government tax monies, which could otherwise be used for education and training but are going for eldercare and public pensions).

There are clearly no easy solutions as current-consumption (including at a government and social level) makes investments in future technologies more difficult.

It is also clear that some low-tech jobs may need to be socially supported as either long-term job and careers and as entry ladders for many people. Notwithstanding, the emphasis should be on helping people opportunistically participate in the higher skilled and better compensated parts of the economy.

Sunday, August 13, 2017

Gasoline Reaches Its Tipping Point - Bloomberg Gadfly

Gasoline Reaches Its Tipping Point - Bloomberg Gadfly

...The fleet of electric vehicles in use worldwide is on track to displace around 100,000 barrels a day of road transport fuel this year -- most of it gasoline -- according to a report published last month by Bloomberg New Energy Finance. They expect that volume to rise to 155,000 barrels a day next year.

...The fleet of electric vehicles in use worldwide is on track to displace around 100,000 barrels a day of road transport fuel this year -- most of it gasoline -- according to a report published last month by Bloomberg New Energy Finance. They expect that volume to rise to 155,000 barrels a day next year.

To be sure, that is a tiny volume compared with global gasoline consumption that was reported by BP Plc at more than 25 million barrels a day in 2016, but that misses the point. It is at the margin where the growing fleet of electric vehicles will make its presence felt.

Take Tesla Inc.'s Model 3 as an example. Once delivered, the current order book of 455,000 cars will displace some 18,000 barrels a day of gasoline demand,

Saturday, August 12, 2017

Behold the Sheer Artistry of Tesla's Bond - Bloomberg Gadfly

Behold the Sheer Artistry of Tesla's Bond - Bloomberg Gadfly

Tesla's worth rests almost entirely on a long-term bet that it sparks a transformation of the global vehicle industry (and energy in general) and emerges at the top of the resulting pecking order. This is ambitious. If it pulls it off, shareholders stand to reap the rewards. If not, they'll reap something decidedly unrewarding.

Now consider the buyer of Tesla's newly minted bond. If Tesla succeeds, then the bondholder gets a coupon currently worth about 3 percentage points over Treasurys and their principal back, maybe with a premium if called early. If Tesla doesn't, then they also stand to lose potentially all or part of their principal, especially as the bond's relatively loose covenants provide room for Tesla to raise more debt.

Which makes that 5.25 percent coupon a coup for Tesla:

Friday, August 11, 2017

How to Slay the Patent Trolls - Bloomberg

How to Slay the Patent Trolls - Bloomberg

...But state governments are fighting back. As of 2016, 32 states had passed laws aimed at limiting NPEs' use of demand letters. Typically, if courts decide a patent holder’s demand letter was unreasonable, it can impose penalties on the person or company making the threats.

... Intellectual property in the U.S. has probably gone past the point of encouraging innovation, and both courts and legislators should think about how to further curb the patenting craze.

...But state governments are fighting back. As of 2016, 32 states had passed laws aimed at limiting NPEs' use of demand letters. Typically, if courts decide a patent holder’s demand letter was unreasonable, it can impose penalties on the person or company making the threats.

... Intellectual property in the U.S. has probably gone past the point of encouraging innovation, and both courts and legislators should think about how to further curb the patenting craze.

Funding Conditions for Tech Startups Soar to a New Record - Bloomberg

Funding Conditions for Tech Startups Soar to a New Record - Bloomberg

...The Bloomberg U.S. Startups Barometer, which tracks the business conditions for U.S.-based private technology companies, reached a record high. A 44 percent increase from a year earlier was driven by a surge in the number of businesses that raised money for the first time, reflecting investors' appetite to back the riskiest companies.

...."There's a lot of frothiness in early stage and seed investing.

...The total amount of money that startups have raised is still down from a year earlier, albeit by less than recent weeks.

...Exits, which deliver returns to investors so they can reinvest that capital to younger companies, are down 29 percent from a year earlier.

...The Bloomberg U.S. Startups Barometer, which tracks the business conditions for U.S.-based private technology companies, reached a record high. A 44 percent increase from a year earlier was driven by a surge in the number of businesses that raised money for the first time, reflecting investors' appetite to back the riskiest companies.

...."There's a lot of frothiness in early stage and seed investing.

...The total amount of money that startups have raised is still down from a year earlier, albeit by less than recent weeks.

...Exits, which deliver returns to investors so they can reinvest that capital to younger companies, are down 29 percent from a year earlier.

Thursday, August 10, 2017

Bitcoin Exchange Gets $100 Million Investment - Bloomberg

Bitcoin Exchange Gets $100 Million Investment - Bloomberg

...Coinbase plans to use the money to expand its engineering and customer support staff, open a New York office for its professional trading platform GDAX and grow Toshi, “a mobile browser for the ethereum network that provides universal access to financial services,” said Megan Hernbroth, a spokeswoman.

...Coinbase plans to use the money to expand its engineering and customer support staff, open a New York office for its professional trading platform GDAX and grow Toshi, “a mobile browser for the ethereum network that provides universal access to financial services,” said Megan Hernbroth, a spokeswoman.

Wednesday, August 9, 2017

Here's What Goldman Is Telling Big Money Clients About Bitcoin - Bloomberg

Here's What Goldman Is Telling Big Money Clients About Bitcoin - Bloomberg

Strategists say ‘hype cycle’ in full effect for cryptos

...According to Coin Schedule, ICOs have raised $1.25 billion this year, outpacing global angel and seed stage Internet venture capital funding in recent months.

Strategists say ‘hype cycle’ in full effect for cryptos

...According to Coin Schedule, ICOs have raised $1.25 billion this year, outpacing global angel and seed stage Internet venture capital funding in recent months.

With $1 Trillion Chasing Deals, Investors Park Cash in ETFs - Bloomberg

...BlackRock Inc. and State Street Corp., two of the world’s biggest providers of ETFs, say an increasing number of institutional investors are using their products to park money earmarked for private funds. These investors -- pension plans, foundations and endowments that are under pressure to meet obligations -- are trying to eke out an extra return on cash that would otherwise languish in a money market fund.

...“It’s difficult to justify sitting in cash for 24 months, so they’re having to think about different ways to fund these types of mandates.”

...how they can use ETFs for asset allocation and cash management.

(warning)

... Carlyle Group LP’s David Rubenstein has said the fundraising market is now the best he’s ever seen, and Apollo Global Management LLC last month raised the biggest-ever buyout fund, with almost $25 billion committed. London-based Oakley Capital has amassed about 800 million euros ($938 million) for its third mid-market private equity fund, people familiar with the matter said this week, more than 50 percent higher than its last capital raise.

https://www.bloomberg.com/news/articles/2017-08-09/with-1-trillion-waiting-for-deals-investors-make-do-with-etfs

...“It’s difficult to justify sitting in cash for 24 months, so they’re having to think about different ways to fund these types of mandates.”

The amount of dry powder -- money raised but not yet invested -- could hit $1 trillion by the end of year in private equity alone, after reaching $963 billion in July, according to researcher Preqin Ltd. That’s pushing out the average time it takes for new commitments to start being invested to as long as three years, up from one year previously, according to State Street.

...the more often chosen route is to deploy against a capital-weighted index. They are buying index exposure.”

ETFs, which have grown to more than $4 trillion in assets, can give investors instant and diversified exposure to an asset class, while allowing for a quick liquidation to meet obligations.

... pension clients, at least in Europe, are increasingly using ETFs to create so-called liquidity sleeves for their portfolios....how they can use ETFs for asset allocation and cash management.

(warning)

... Carlyle Group LP’s David Rubenstein has said the fundraising market is now the best he’s ever seen, and Apollo Global Management LLC last month raised the biggest-ever buyout fund, with almost $25 billion committed. London-based Oakley Capital has amassed about 800 million euros ($938 million) for its third mid-market private equity fund, people familiar with the matter said this week, more than 50 percent higher than its last capital raise.

https://www.bloomberg.com/news/articles/2017-08-09/with-1-trillion-waiting-for-deals-investors-make-do-with-etfs

Tuesday, August 8, 2017

Patrick Cox's Tech Digest | Mauldin Economics

Patrick Cox's Tech Digest | Mauldin Economics

The amount of data in a single human genome is staggering. To understand how genes affect health, though, we need data from huge numbers of genomes. We also need to study the medical records of those whose genomes are analyzed. Proteomics and metabolomics make the task even more complex.

Proteomics

Proteomics is the large-scale study of proteomes. A proteome is a set of proteins produced in an organism, system, or biological context.

Metabolomics

Metabolomics is the large-scale study of small molecules , commonly known as metabolites, within cells, biofluids, tissues or organisms. Collectively, these small molecules and their interactions within a biological system are known as the metabolome.

----------

...Jim Mellon recently joined the race when the company he co-founded, Juvenescence Limited, announced a joint venture with Insilico Medicine. The joint venture is called Juvenescence AI. It will focus on developing compounds for the treatment of aging and age-related diseases...

The amount of data in a single human genome is staggering. To understand how genes affect health, though, we need data from huge numbers of genomes. We also need to study the medical records of those whose genomes are analyzed. Proteomics and metabolomics make the task even more complex.

Proteomics

Proteomics is the large-scale study of proteomes. A proteome is a set of proteins produced in an organism, system, or biological context.

Metabolomics

Metabolomics is the large-scale study of small molecules , commonly known as metabolites, within cells, biofluids, tissues or organisms. Collectively, these small molecules and their interactions within a biological system are known as the metabolome.

----------

...Jim Mellon recently joined the race when the company he co-founded, Juvenescence Limited, announced a joint venture with Insilico Medicine. The joint venture is called Juvenescence AI. It will focus on developing compounds for the treatment of aging and age-related diseases...

I take Juvenescence AI seriously not just because Mellon has been right so often in the past. The computational side of the partnership, Insilico Medicine, may be the most driven company in AI today....

...Calico, Google’s medical venture...

...Many of Insilico’s researchers came to be there by winning online “hackathons”. These tests were designed to find the brightest AI experts and biologists, wherever they are. Also, most of the company’s R&D facilities are offshore. That means its costs are a fraction of its US counterparts’...

...The tools employed by Insilico Medicine are deep-learning neural networks that mimic human thought processes. These algorithms, run on supercomputers, analyze data too massive for human minds to comprehend.

Already, the company has identified dozens of compounds with potential to modify biological pathways involved in aging.

...Generative Adversarial Networks (GANs). GANs are neural networks capable of creation. GANs synthesize output based on specifications set by the programmer. You’ve probably heard about the GAN than can generate images of paintings in the style of specific artists based on user-provided descriptions.

...

One type of GAN is the generative Adversarial Autoencoders (AAE). AAEs can be trained to create content to satisfy the programmer’s rules. Imagine an AI that can be instructed to produce a set of molecules that prevent the deterioration of nerve cells in patients at risk for dementia.

AAEs can also predict adverse effects of a drug. AAEs can also evaluate the probability of a drug passing human clinical trials. Insilico Medicine has demonstrated the first proof of concept of AAEs in oncology.

AAEs have the potential to disrupt the entire drug development field. Once we know how a drug works, the program could be tasked with finding another compound that can bring about the same molecular changes.

This breakthrough has huge implications. For the first time, the potential exists to quickly reverse engineer drugs without violating their patents. While this may scare big drug companies, it’s good news for AI startups like Juvenescence AI and healthcare consumers.

Juvenescence AI will help improve Insilico Medicine’s AIs in return for the right to choose the best of its discoveries. According to Juvenescence CEO Jim Mellon and COO Alex Picket, among those candidates is at least one compound that appears to be a true anti-aging compound.

Monday, August 7, 2017

VAT Thoughts from the Frontline - Hot Summer Mailbag - btbirkett@gmail.com - Gmail

Thoughts from the Frontline - Hot Summer Mailbag - btbirkett@gmail.com - Gmail

Trade War Games

Here’s a comment responding to “Trade War Games” and my concerns about rising protectionism.

Much of America’s trade deficit stems from our refusal to adopt a Value Added Tax when virtually all of our trading partners have one. To review, VAT is added to the cost of everything purchased inside a country, including imports, but does not apply to export sales. So, if the total tax burden in two countries is equal and the actual manufacturing cost is equal but one uses VAT and the other does not, you can expect that the total cost to produce, ship, and sell goods in BOTH countries will be lower for the company located in the country with the VAT. Those who wish to challenge this notion are welcome to sit down with paper and work it out.

Companies in the non-VAT country pay both the full tax in their own country plus the VAT when they try to export to the VAT country against competition from the locals who pay only the full tax. Meanwhile, in the non-VAT country, imports enjoy a tax reduction equal to the VAT percentage while local makers pay full tax.

This unfairness has persisted since the 1950s when the VAT was invented. It was, long ago, “justified” in Europe by the need to rebuild their destroyed in World War II economies. I humbly suggest that the need for America to subsidize manufacturing in Europe [and China] via refusing to adopt a VAT is long since past and that using a VAT here, possibly as an exchange for lower or no income taxes, would right our trade situation in multiple industries at once.

And, since most of our trade partners already have a VAT, their “bully pulpit” to complain about the US starting a trade war doesn’t exist ... they started it, as the saying goes, long ago. – Rolf Parta

John: Regular readers know I would like to see a VAT system in the US. I think it could eliminate or greatly reduce both income and payroll taxes. For some reason, though, the politicians who could make this happen refuse to consider the idea. They fear – perhaps reasonably – that we would end with both a VAT and existing taxes on top of it. There are ways to prevent that from happening, but it would take more vision and dedication than the current congressional leadership seems to possess.

And let me make a further point. Today’s deficits will grow even larger because of entitlement programs. The only way to get serious money, and by that I mean the trillions it will take to balance the budget or even come close, is a VAT. Let’s face it: We are going to get a VAT sooner or later – probably under a Democratic Congress and administration, but Democrats are not going to look kindly upon lowering income tax rates. A Republican administration, on the other hand, could use a VAT to completely eliminate Social Security taxes and deeply cut corporate and income taxes.

The Republican leaders in Congress currently believe that they’re going to be able to make cuts in programs and reform entitlement spending such that they can handle future deficits. Yet they can’t pass even a simple tax reform package or healthcare reform. This is the Gang That Can’t Shoot Straight.

At the beginning of the year I was really encouraged that Republicans could act and we would get major tax reform and healthcare reform and bureaucratic reform that would push out a potential business-cycle recession or worse at least three or four years. Now, they are likely to pass something they will call tax reform, but it will actually be just tinkering around the edges. Real change requires real change. Real tax reform requires real tax reform. I will openly admit that “my team” talked a good game but just hasn’t been able to move the ball down the field. I’m extremely disappointed.

Saturday, August 5, 2017

China Shuffles Its Debt Around - Bloomberg

China Shuffles Its Debt Around - Bloomberg

...By tonnage, iron-ore futures trading on July 31 exceeded China's entire iron-ore output for all of 2016. ...

...True deleveraging will require some painful steps, such as denying businesses new funding, letting more companies fail and accepting the potential increases in unemployment that result. That won't be fun for anyone, but it will signal -- as nothing else has -- that China is finally serious about these problems.

...By tonnage, iron-ore futures trading on July 31 exceeded China's entire iron-ore output for all of 2016. ...

...True deleveraging will require some painful steps, such as denying businesses new funding, letting more companies fail and accepting the potential increases in unemployment that result. That won't be fun for anyone, but it will signal -- as nothing else has -- that China is finally serious about these problems.

Wednesday, August 2, 2017

Billionaires make it rain on Plenty, the indoor farming startup | TechCrunch

Billionaires make it rain on Plenty, the indoor farming startup | TechCrunch

...The company’s first crops will be on shelves in undisclosed supermarkets and available online in the San Francisco area next year....

Aerofarms, BrightFarms, Bowery Farming and Freight Farms are all developing indoor farming systems that purport to provide better, fresher, cheaper produce at a fraction of the cost of organics and with a similar footprint....

....Indeed, several companies, including Atlanta-based PodPonics, Vancouver’s LocalGarden and Chicago-area FarmedHere, had to close down because they weren’t viable businesses.

...The company’s first crops will be on shelves in undisclosed supermarkets and available online in the San Francisco area next year....

Aerofarms, BrightFarms, Bowery Farming and Freight Farms are all developing indoor farming systems that purport to provide better, fresher, cheaper produce at a fraction of the cost of organics and with a similar footprint....

....Indeed, several companies, including Atlanta-based PodPonics, Vancouver’s LocalGarden and Chicago-area FarmedHere, had to close down because they weren’t viable businesses.

Subscribe to:

Comments (Atom)