...Trade deficits or surpluses aren’t bad. Nor are they good. They are a natural characteristic of post-barter economies that have achieved division of labor… a sign of success, in other words. For certain countries, there are times when trade deficits simply don’t make a difference. And then there are times when they can be devastating. It all depends on the current account surplus, a concept we will deal with below, and/or whether the country’s currency has reserve status. It’s not hard to understand, so let’s dive in....

...Almost every economist in the world accepts this basic Gross Domestic Product equation: Y = C + I + G + (X – M). This is where Y is GDP, C stands for consumption, I stands for investments, G stands for government expenditures and (X – M) stands for exports minus imports. This is called an accounting identity. In the same way that 2+2 = 4, an accounting identity is always and everywhere true.

...So math says we will run a trade deficit with somebody. It doesn’t necessarily have to be China, but our economy is not suited to be a net exporter. We can buy our T-shirts from Vietnam or Pakistan instead of China, but it is still a trade deficit.

Why can’t we make T-shirts in the US? Because they will cost more, which means consumers will buy fewer, which means a smaller economy with fewer jobs. I know it is counterintuitive but that is just the reality of a world that Ricardo described.

So we see trade deficits aren’t necessarily bad, but that’s not all. Even if we wantedto get rid of the trade deficit, it’s not clear we could—at least without creating some serious side effects. Martin Wolf said it well in the Financial Times last week.

Serious economists, back to Adam Smith, would insist that seeking a surplus with every trading partner is not “winning.” It is absurd. This is not even intelligent mercantilism, which would focus on the overall balance. Yet, particularly with free capital flows, overall balance is a foolish goal and one that trade policy cannot achieve. It is incredible that such primitive ideas rule the most sophisticated country on earth.

Martin’s point is well taken. Whether a country’s balance of trade is helpful depends highly on the circumstances. They aren’t automatically good or bad. The US trade deficit is helpful, as I’ve described, but in Greece a few years ago it was disastrous. The internal trade deficit southern eurozone countries ran with Germany (and other highly productive European countries) let them run up massive government, personal, and corporate debt, which they couldn’t pay. Greece was just the first and Italy is lining up to be the next.

In a normal world, when Greece used the drachma, the currency valuation would have fallen and made Greek citizens demand fewer imports. What actually happened was all the debt became due, forcing massive austerity in a kind of shadow devaluation. It was simply brutal.

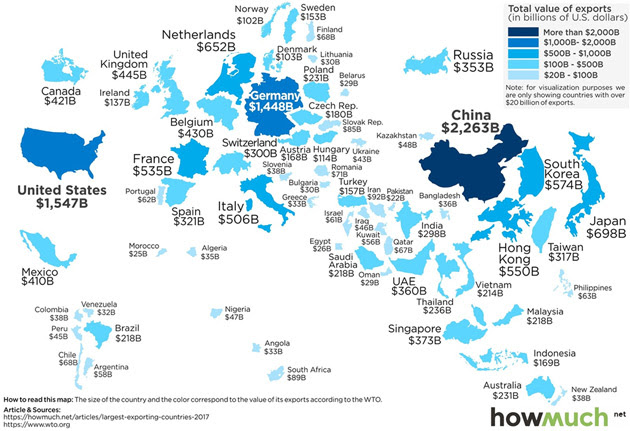

Germany’s corresponding trade surplus with other EU countries is not necessarily great, either. Notice that in the chart below, Germany is the world’s third-largest exporter. It could not do with a strong currency like the Swiss franc. It works only because it is in the eurozone with weaker economies. A Volkswagen or Mercedes-Benz valued in deutsche marks that cost 50% more wouldn’t compete very well on a global scale. Germany will learn that the hard way before this is all over.

No comments:

Post a Comment