...According to the Institute for International Finance, global debt was $244 trillion as of Q3 2018. More than half of it was financial and non-financial corporate debt. About 27% ($65 trillion) was government debt (not counting unfunded liabilities, which are huge).

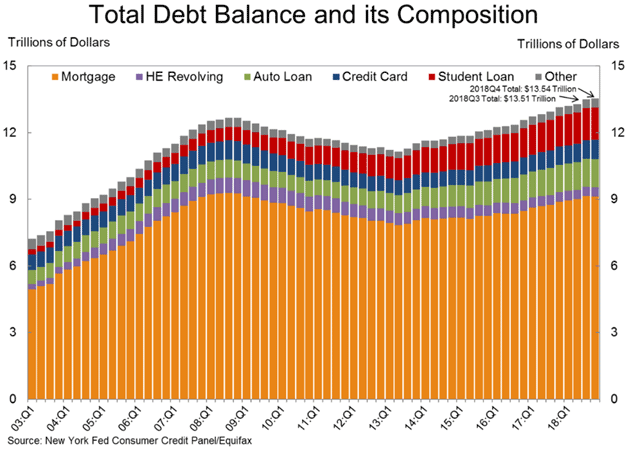

Household debt was the small category and hasn’t grown that much in the US. Here’s a closer look via the New York Fed’s quarterly survey.

You can see in the chart how US households retrenched in the recession, then began slowly adding more debt in 2013 and after. Mortgage debt is still slightly below its pre-crisis peak.

...Falling asset prices won’t be a result of the next recession; they will cause the next recession. And asset prices will fall when the free-flowing credit that pushed them so high recedes, which it is doing right now thanks to the Fed’s two-factor experiment of simultaneously hiking interest rates and reversing QE.

...The next marker will be some high-profile debt defaults, probably among lower-rated issuers. I don’t know who: WeWork, Tesla, name your favorite. But somebody is going to run out of cash and find themselves unable to refinance for the 97th time. And then the real fun will begin.

...Here’s what they observe. Japan has spent decades with zero or negative rates, engaged in massive QE and boondoggle spending, gone in and out of recession, and somehow stayed on its feet. An economic boom it is not, but the country avoided the worst nightmares. That’s a “win” in the way central bankers think.

Meanwhile, Mario Draghi’s European Central Bank tried a similar strategy to the extent it could, given that the Eurozone lacks a unified fiscal authority. It seemed to be working, well enough that the ECB decided last year to end some of the extraordinary measures. But simply talking about it appears to have put the Eurozone economy into a mild flu. So now they are back on a Japan-like course.

Italy alone has so much debt it could easily become another Greece, but far larger and more difficult for the rest of Europe to rescue. Italy is already in recession, albeit a mild one (so far), but its debt load is still rising. At some point, it becomes a systemic risk to the Eurozone and EU.

...Working off that debt will take years, possibly decades. Hence the long, slow Japanization I’ve described. I don’t think we will endure it for 30 years like Japan has. We will instead force a worldwide default, which I’ve dubbed the Great Reset.

No comments:

Post a Comment