Mauldin SIC 2019: William R. White

Before we jump into William White’s presentation, let’s take a quick look back at the last two letters, which highlighted Lacy Hunt and David Rosenberg.

The prior two letters concluded with the following:

Lacy Hunt, Ph.D.: What’s going to happen?

- I [Lacy Hunt] think we are going back to zero bound (Fed Funds rate to zero percent). Because we expect velocity to fall and we are concerned that we will be stuck in a quagmire with a zero percent bond for some time. Yield curve will be a lot flatter. His fund has greater than 20-year duration.

- It will be ugly economically.

- We are not going to get growth. We are not at the end of the declining rate cycle… we haven’t seen the low in yields. He favors investing in long-term government bonds for total return.

David Rosenberg: What’s going to happen?

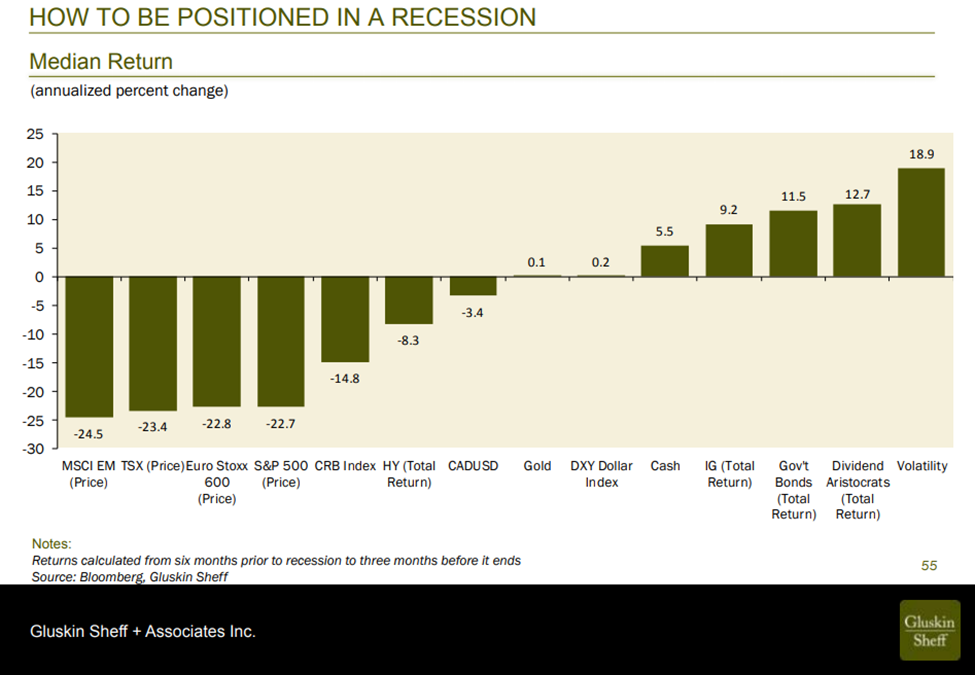

Rosie argues that recession is coming, rates are heading lower and we will move to even more unconventional Fed policy. He recommends the following asset classes will outperform (see next chart) and suggested that the 10-year Treasury may earn a total return of more than 11% over the coming 12 months. He also likes quality dividend payers and going long volatility. For non-geeks, that is a bet that volatility will pick up to the downside (it will get very bumpy) and a way to play that for profit is to invest in the VIX. My dad would say, a play that is “not for the faint of heart.”

Rosie shared this slide:

Notes and Charts:

No comments:

Post a Comment