Why It’s So Hard for Startups to Create Wealth in Europe

Lawmakers across the Continent haven’t given startups the compensation tools they need to share profits with employees. That’s changing.

Johannes Reck should be feeling pretty groovy. He’s the co-founder of one of the hottest startups in Berlin. GetYourGuide lets holiday makers book tours online in 150 countries and is on course to increase ticket sales this year by 75%. In May it raised $484 million from investors, and it’s now valued at more than $1 billion.

Reck’s company is precisely the type of unicorn European policymakers want to see more of as they champion entrepreneurship that can kick-start much-needed economic growth. But he’s fuming. “It’s not even that I am disappointed—I am angry, really angry, because you don’t need to reinvent the wheel here,” says Reck, a 34-year-old German with the wiry build of a marathoner. “It’s not like we are asking politicians to do something unheard of.”

Illustration: Jaya Nicely for Bloomnberg Markets

The problem? Reck can’t provide his people with a stake in the future of their venture without incurring crushing costs and hassle. For decades, tech mavens in the U.S. have used stock options for employees to spur innovation—and unprecedented wealth. Unlike Silicon Valley, where equity incentive plans have become as ubiquitous as foosball tables and midday yoga sessions, the options culture has yet to take root in many European countries. While some lawmakers are taking action to loosen restrictions on pay, it’s going to be hard to close the gap when income inequality is becoming a more urgent issue on both sides of the Atlantic.

European consumers and lawmakers here have long decried outsize paydays as unfair and vulgar. A few years ago the Dutch capped bonuses for bankers, money managers, and other financial professionals at 20% of their base salaries. Entrepreneurs must navigate onerous tax rates and restrictions that often make equity sharing and options more trouble than they’re worth. When employees in Germany exercise options, they have to pay income tax on the difference between the fair market value and the strike price, and that rate runs from 14% to 47.5%. They also have to pay a 25% capital-gains tax on additional profits when they sell their shares.

In contrast, American employees typically pay a 0% to 20% rate on capital gains when options are redeemed, though they may have to pay additional levies when they’re exercised, depending on the timing and the type of equity incentive program. Germany and 14 other countries, including Sweden and the Netherlands, are more burdensome than the U.S. regarding options, according to a 2018 study by Index Ventures, a venture capital firm in London and Silicon Valley.

For entrepreneurs and venture capitalists, the problem isn’t just about attracting top talent. The compensation bind may also be a big reason why Europe doesn’t produce world-beating tech companies at the same level as the U.S.

Other forces are at work, too. Even though they’re part of the European Union, member states remain a fragmented collection of markets that can’t muster the borderless scale achieved in America. Plus, there’s the widely shared belief that European business culture simply doesn’t tolerate the experimentation and inevitable failures that are par for the course in, say, Silicon Valley. While governments across the EU have devoted hundreds of millions of euros to venture capital-style programs to invest in startups, the one tool entrepreneurs truly want remains out of reach.

“There are two ingredients to growth in a startup,” says Martin Mignot, an Index Ventures partner. “One is capital, and the other is talent, and when you’re not highly profitable you have to incentivize employees on the promise of the upside. Your currency is that promise.”

Spotify, Klarna, and TransferWise lead a roster of European companies that have shaken up industries with new products and created wealth for their investors and employees. Likewise, a handful of countries hew to the American approach on compensation; Britain, Italy, Portugal, and, interestingly enough, France, tax options as capital gains when they’re cashed in.

Yet they’re the exceptions. In many other European markets, startup founders have to use various workarounds to vest employees in their businesses. In Sweden, options can be taxed as income at rates of more than 50%. Klarna, a digital payments powerhouse, sidesteps the bill by issuing warrants priced at fair market value using the Black-Scholes model, which are taxed as capital gains at 25% to 30% at the time of sale. But, as incentives, fully priced warrants aren’t as potent as cheaper priced options, says Knut Frangsmyr, Klarna’s chief operating officer. Companies in Austria, the Czech Republic, Germany, and Spain distribute “virtual share options,” but the instruments are really just cash bonuses by another name and may not deliver the windfalls that bona fide options do when a company is acquired or holds an initial public offering.

In Germany, at least, help may finally be on the way. Bettina Stark-Watzinger, chairwoman of the Finance Committee in the Bundestag, Germany’s parliament, has crafted legislation that would cut the tax rate on stock options in half by treating them as capital gains instead of income. Stark-Watzinger, a member of the centrist opposition Free Democratic Party, argues that Germany has become complacent about supporting digital innovation.

She worries that promising tech companies will decamp to other countries if lawmakers don’t change things. “We are so preoccupied with the economy of the last century,” Stark-Watzinger says in her office suite near Berlin’s iconic Brandenburg Gate. “We are so proud of our trade surplus and our automobile industry, but we have fallen behind in the digital economy. This is where value and growth will come from in the future.”

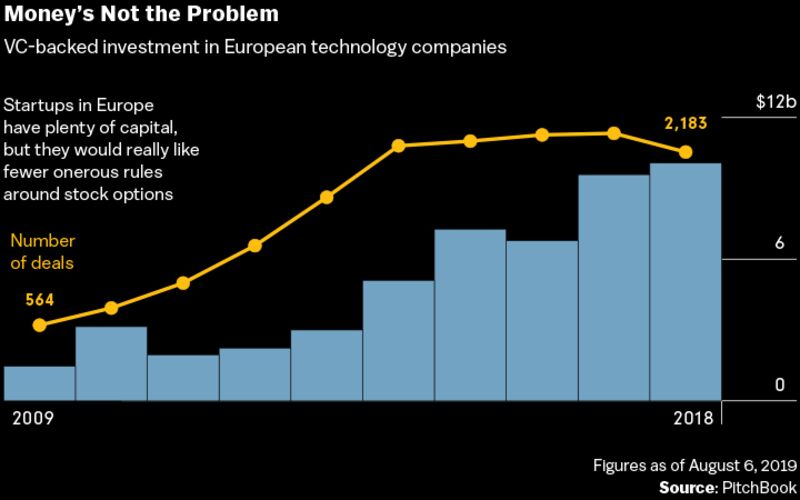

VC-backed investment in European technology companies

It won’t be easy for Stark-Watzinger to persuade parties in Germany’s governing coalition to embrace legislation that might be seen as favoring workers in the relatively well-off tech sector. Germany has been far less comfortable than the U.S. and the U.K. about carving out exceptions in its tax system for specific sectors, even to stimulate innovation, says Michael Mandel, an economist at the Progressive Policy Institute in Washington who has studied the issue. It wasn’t until this year that the German government proposed a tax break for research and development investments across industries, a common policy in many Western countries.

Whenever the issue of tax credits has come up in the Bundestag, lawmakers have tended to question whether lower revenue will undermine support for social services—a political third rail in a nation that provides free tuition at public universities an

VC-backed investment in European technology companies

VC-backed investment in European technology companies

It won’t be easy for Stark-Watzinger to persuade parties in Germany’s governing coalition to embrace legislation that might be seen as favoring workers in the relatively well-off tech sector. Germany has been far less comfortable than the U.S. and the U.K. about carving out exceptions in its tax system for specific sectors, even to stimulate innovation, says Michael Mandel, an economist at the Progressive Policy Institute in Washington who has studied the issue. It wasn’t until this year that the German government proposed a tax break for research and development investments across industries, a common policy in many Western countries.

Whenever the issue of tax credits has come up in the Bundestag, lawmakers have tended to question whether lower revenue will undermine support for social services—a political third rail in a nation that provides free tuition at public universities and universal health care.

Mandel says that just because Washington is willing to bet that forgoing tax revenue now will result in bigger inflows later, that doesn’t mean Berlin should. “Germany has a very successful industrial system, so why should they break something that’s working?” he says. “And while German leaders would love to have more unicorns, they might want to develop them their way, not the Silicon Valley way.”

Even so, there’s little doubt that stock options have fueled wealth and innovation in the U.S. Companies such as PayPal Holdings Inc., the online payments pioneer, haven’t just made their founders wildly rich; members of the so-called PayPal mafia like Elon Musk, Peter Thiel, and Reid Hoffman went on to start ventures that minted fortunes for rank-and-file employees who can then start their own companies and begin the cycle anew.

Index’s Mignot calls this the flywheel effect. The flywheel isn’t nonexistent in Europe: The 2018 IPO of Adyen, a Dutch digital payments processing company, made its top brass billionaires. Yet reforming options rules across the EU would help make creating such flywheels the norm instead of the exception, says Magnus Henrekson, the director of the Research Institute of Industrial Economics in Stockholm. At the top of the reform list is making sure beneficiaries aren’t hit with taxes until gains are realized.

GetYourGuide’s Reck, for one, is relieved the issue is finally on the agenda. In many respects, his company looks like a classic Valley performer. It’s backed by SoftBank Vision Fund, and in September it moved its headquarters into a renovated electrical substation that’s a model of post-industrial hipness, with exposed red brick walls, cast-iron beams, and fridges stocked with high-caffeine Club-Mate drinks.

Even though Reck was determined to add the pièce de résistance—options—he gave up after realizing that the upfront tax bill would empty workers’ pocketbooks. So he implemented ersatz shares that are essentially cash awards tied to GetYourGuide’s valuation.

Featured in the October / November 2019 issue of Bloomberg Markets.

Cover artwork: Victo Ngai for Bloomberg Markets

Those payouts are taxed as income, but only when they’re redeemed, and there’s no capital-gains tax. But GetYourGuide, which isn’t profitable yet, must reserve cash to cover the outlays. “This has massive disadvantages for the company,” says Reck. “We have a huge liability on our balance sheet toward employees, which is obviously weird. And in an IPO scenario, this is something that you have to explain to investors, and that’s not great.”

Raisin, another startup, did bite the bullet, granting stock options to its employees. Located in Prenzlauer Berg, a Berlin neighborhood of funky cafes and old Soviet-style apartment buildings, Raisin runs an online “deposit marketplace” that matches European savers with banks offering the best interest rates. Backed by Goldman Sachs Group Inc. and PayPal, it’s invested €16 billion ($17.7 billion) in assets.

Frank Freund, Raisin’s co-founder and chief financial officer, isn’t wild about requirements that date to a bygone era. Whenever Raisin grants shares, a notary must literally read the lengthy compensation agreement aloud to both the employee and Freund at a hearing that can take up to 90 minutes. Still, Freund believes the company made the right call. “When you have participation in the company’s performance and growth, it makes a big difference,” he says. “It would be great if significantly more companies would follow our example in Germany.”

Scott Chacon will take a pass on that. Chacon is an American entrepreneur who co-founded the software development site GitHub Inc. He’s been spending time in Berlin with his latest venture, an online language-tutoring service called Chatterbug Inc. Following a panel discussion, he mingles with local techies over beers in a leafy courtyard outside a VC firm.

Amid the bonhomie, he says Chatterbug chose to base itself in San Francisco and Berlin to tap into the German capital’s diverse expatriate pool. It offered employees a choice of U.S.-style options or German-style virtual shares. But ensuring the different programs were equitable was impossible. Chatterbug now offers new employees restricted stock units that aren’t pegged to a strike price (as options are) and are taxed as income if they’re cashed in during a sale of the company.

Standing alongside Chacon, Anne Leuschner, the company’s COO, chimes in. She says Chatterbug’s compensation fudge isn’t ideal, but it’ll do for now. “I wish we had the same system as the U.S.,” she says. “But they don’t want us to get rich in Germany.”

Robinson covers wealth in London. With Birgit Jennen

No comments:

Post a Comment