Big economic storms are rare and usually end quickly, but they tend to have long-lasting effects. Today I want to talk about a storm 50 years ago that still affects us now. Important things happened in the 1970s.

I personally remember that decade well. I was in my 20s and they were formative years. I met people and learned things that led me where I am now. The funny part is its larger events, important as they were in hindsight, didn’t get nearly as much attention at the time. Those events did not even register to me as important. We didn’t have social media and 24-hour news networks. The “well-informed” people read local newspapers and watched Uncle Walter (Cronkite) in the evening. Business people and bankers read The Wall Street Journal. Political junkies read The New Republic or National Review. But none of us really knew everything as it happened, with the one exception of the Vietnam War. Selected portions of that were played out on our TVs in the evening and in papers. For that matter, most business and national news was also only consumed in light detail. Even back then, there was too much to portray in 30 minutes or a short column.

In any case, we are still dealing with the legacy of that time. But as I’ll show at the end, we may be starting to at least recognize some of the mistakes. That’s the first step to actually fixing them.

1971 Memories

A half-century later we are still enduring the effects of 1971, when Nixon “closed the gold window.” But to understand why, we have to consider the window’s origin.

Currency devaluations, leading to inflation, depression, and worse, were common before World War II. The 1944 Bretton Woods conference designed a new system which took effect in the 1950s. The US would hold most of the world’s gold, guaranteeing other nations could convert their gold reserves at a fixed $35 per ounce rate. Essentially, this tied other countries to the US dollar.

Bretton Woods “worked” for almost 20 years but with side effects, not unlike today’s euro problems. You can’t tie independent countries with their own fiscal policies to the same currency. It guarantees balance of payment problems.

Starting in the mid-1960s, various European countries began demanding payment for their dollars in gold. They wanted the US to balance its budget, which had gone wildly into deficit because of the Vietnam War. The US was literally using Air Force planes to ship gold from Fort Knox to New York and outbound. You can read many interesting stories like this one. We tend to think of crises as happening over very short periods. This one was building for years.

West Germany, faced with having to devalue the Deutsche Mark, instead abandoned the Bretton Woods system in May 1971. The dollar weakened considerably, concurrent with rising unemployment and inflation. Nixon appointed former Democratic Texas Governor John Connally as Treasury Secretary in early 1971. In an international meeting, Connally uttered the famous saying: “The dollar is our currency but your problem.”

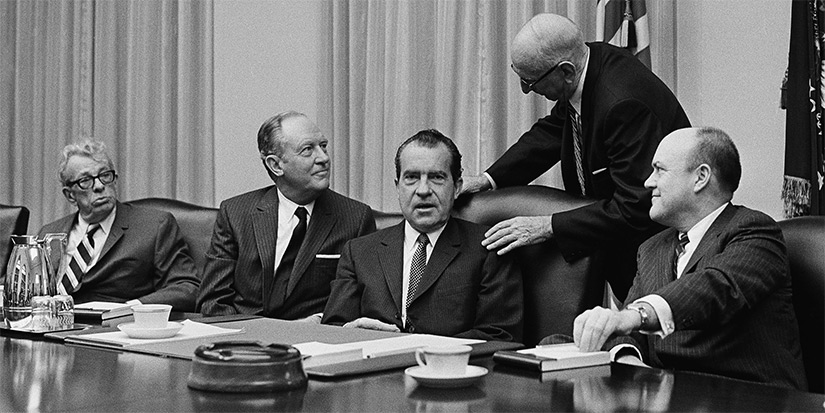

As the situation worsened, Nixon called an emergency meeting at Camp David which included the Federal Reserve Chairman Arthur Burns and a young Paul Volcker. After much debate, Nixon listened to the ever-confident Connally. On August 15, 1971, President Nixon ended the Bretton Woods system and also imposed wage and price controls in the US. (CPI inflation was almost 6% at the time.) He added import tariffs, too. Basically, the opposite of what most economists would suggest. The dollar crashed even more and we had to invent the word “stagflation” to define the widespread misery. This was all later dubbed the “Nixon Shock.”

We can’t blame Nixon for everything, though. Other things were happening at the same time: social unrest amid the Vietnam War, the civil rights movement, more women entering the workforce, technological changes, and more. Much of it was good and necessary but still disruptive.

But whatever the causes, that period seems to have been a kind of economic fulcrum. I’m not the only one to notice it, either. A host of writers and websites have chronicled the seemingly sudden changes. For instance, try WTF Happened in 1971? You’ll see page after page of charts, each with a little red arrow pointing to 1971 as a turning point.

You can browse those later but for today I want to focus on income and job-related changes. I think they are the most relevant to today’s challenges, as we will see below. But first let’s quickly review some charts.

Hourly compensation grew roughly in line with productivity from 1948 until the early 1970s. From there, productivity rose far faster than income.

Source: WTF Happened in 1971?

Similarly, wages rose in line with GDP per capita before splitting in the 1970s.

Source: WTF Happened in 1971?

Income at the top of the pyramid, relative to the bottom 90%, began rising in the 1970s after a long post-Great Depression decline.

Source: WTF Happened in 1971?

This next chart again shows that the income gains were not as widely shared since 1971.

Source: WTF Happened in 1971?

If we really want to make it look bad, let’s look at just the top 1%. I should point out that this gets somewhat skewed by the increasing amounts made by a small number of entrepreneurs who created wildly profitable businesses. Nevertheless, the simple fact of the matter is we live in a relative world. Relative to the average worker, the top 1%, no matter how they ended up there, are incomprehensibly wealthier than the average person.

Source: WTF Happened in 1971?

One reason for that is the productivity we talked about earlier. It really shows up as the capital equipment and technology which is bought to reduce the cost of labor (robots, bank ATMs, computers, automated production lines, and many others). It all reduces the share of income going to labor while raising income for machine-owning capitalists.

Source: WTF Happened in 1971?

Let’s note a caveat to the above chart. Economists use the Gini coefficient to measure the statistical dispersion of income within a nation or any other group of people. A Gini coefficient of zero expresses perfect equality, where all values are the same (for example, where everyone has the same income). A Gini coefficient of one (or 100%) expresses maximal inequality among values, where one person makes all the money.

Quite often, the Gini coefficient as used by economists only measures income and does not include taxes and/or government transfers (like food stamps or tax credits). The chart below comes from a recent Wall Street Journal op-ed by former senator (and economist) Phil Gramm. It shows the Gini coefficient both with and without federal payments to lower income households (transfers) and taxes. Viewed this way, the Gini coefficient has been roughly stable since 1970.

Source: The Wall Street Journal

Let me state emphatically, this does not negate the real problem of income and wealth disparity. You can’t dismiss those realities. The income differences are real and the wealth disparity even worse. Those transfers simply maintain a semblance of balance, at great and rapidly growing cost.

Given that the technological revolution combined with increasing digitalization of the economy is going to make that income differential even more stark, we in the US are going to have some very difficult choices over this next decade.

Now, let’s get back to data from 1971. Income for the average Black American, relative to White Americans, rose in the 1950s and 1960s, then slowed considerably in the 1970s and after.

Source: WTF Happened in 1971?

Flat or slow wage growth is bad enough, but far worse when living costs are rising. That’s what has happened… and guess when it started.

Source: WTF Happened in 1971?

Owning your home is supposedly the key to financial success. But after the 1970s, home prices in major cities rose far faster than incomes did. This same phenomenon was happening all over the country.

Source: WTF Happened in 1971?

You can debate some of these numbers and their sources, but it’s clear the 1970s were a turning point in the average American’s financial condition. Wage growth stagnated while living costs kept rising. Not always and everywhere, but enough to form a long-term trend that is increasingly problematic.

It would be less problematic if either side of the equation were different. Income rising commensurate with inflation, or flat inflation along with flat income, would be a different ball game. But that’s not what happened.

I write often about inflation. This time I want to look at the other side of the ledger. Why haven’t wages grown like they once did?

IQ Tests

Most people derive their income from their employment. That’s why unemployment is a problem. It’s also why people want better, higher-paying jobs.

We say the path to a better job is to increase your skills. In an ideal economy, every worker would match with a job that fits their particular skills. Unfortunately, we have barriers. In the 1960s there were efforts to remove race as a job barrier. The 1964 Civil Rights Act banned pre-employment tests, which had sometimes been used to screen out minorities, unless they were directly relevant to the job.

Litigation followed to define exactly what that meant. Many companies had been in the habit of giving IQ tests to job applicants. In 1971 the Supreme Court ruled (Griggs v. Duke Power Co.) such tests were overly broad. The court also gave employers the burden of proving any pre-employment tests had legitimate business purposes.

This was difficult and risky, so employers found another screening method: demanding college degrees for many roles that hadn’t previously required them. It wasn’t what LBJ had in mind and actually had the opposite effect, but it was legal. Once again, well-intentioned social policies backfired.

Note this all happened about the same time Nixon closed the gold window. I suspect it also contributed to some of the sharp turns in those charts above.

When government makes hiring people more difficult, employers will find different ways to hire (often fewer) people. They may start by squeezing more productivity from the workers they already have. They will also automate more tasks, essentially expanding the labor supply with non-human labor. This puts downward pressure on wages.

But this particular method was even worse, because it told people the only way to advance their careers was to get a difficult, expensive, and time-consuming college degree. This further disadvantages poorer students, some of whom then go into debt to pay for degrees.

Do these degrees really deliver anything employers need? Sometimes, but we have established a system in which people think they need a degree, any degree, just to get a foot in the door. And they’re not wrong.

Those who are employers know how this works. Some highly skilled positions are hard to fill, but they tend to be those where all the applicants have degrees anyway. So education is kind of a non-factor there. At the other end are roles where you have too many applicants, and you need some impartial way to prioritize them. College degrees are handy in that case, even if not strictly required for the job.

I can personally say mea culpa. Back in the 1980s up until the mid-2000s, but especially after the development of online job websites, I would advertise for a job and get lots of applicants. I remember once getting 300 applications for an executive assistant role. A college degree wasn’t really necessary; talent and skill were. But we had to sort through 300 applications. The “easy” solution was to simply start with the college graduates.

That’s not unreasonable. Even if someone’s degree is far afield from what you do, the fact they have one gives you some useful information. You know they are willing to sit in a classroom, turn in assignments, take tests, and otherwise go through a defined process to reach a goal. These are helpful.

The problem is those skills aren’t unique to college graduates. Many others may have them, but haven’t had the opportunity to prove it. Employers would have a larger talent pool if they had other ways to sort it, beyond the presence or absence of a college degree.

Ironically, requiring college education for jobs that don’t really need it aggravates the income disparity you might think it would fix. It becomes a kind of self-fulfilling prophecy. Employers require degrees for higher paying jobs, so of course the higher paying jobs go to people with degrees.

The Jobs Problem Is Really a Data Problem

College degrees have become a proxy for the IQ tests that were made illegal 50 years ago. They aren’t a particularly good proxy, but large employers lack better options.

This is an economic problem for everyone. People contribute more to growth when they are deployed efficiently in jobs that fit their particular talents and goals. Businesses filled with workers who are just there for a paycheck tend not to produce much, and may even be a net drain on the economy.

Data from the National Federation of Independent Business and other groups consistently shows that finding skilled workers is a top problem for employers. There are lots of jobs but matching them with people who can do them is a real issue. It’s a big problem, especially for small businesses where the entrepreneur is trying to produce a product, increase sales, and a dozen other things all at once.

What we need are ways to

- Define the specific skills needed for each job role, and

- Identify people who have those skills, and

- Match them with each other.

Moreover, the matching process has to be more efficient than sorting through resumes, and objective enough to not discriminate in illegal ways.

All that is possible without college degrees. Many professional organizations offer certification programs, specific to certain job categories, which interested people can achieve far more easily and less expensively than a college degree. Some people acquire specialty skills in military service. These offer the kind of objective, third-party certification employers need to see. They just need to see it.

In other words, some of our economy’s jobs problem is really a data problem. We have many jobs available. We also have many workers available, who already have the skills employers want, or could acquire them fairly soon.

Yet many employers are still hiring more by pedigree than skill. In so doing, they may reduce their own odds of success. One recent study mentioned in The New York Times found that 74% of new US jobs require a four-year college degree, which only one-third of American workers possess. That’s a recipe for frustration for both employers who can’t find workers and workers who can’t find jobs. Let’s quote from that article:

For the past four decades, incomes rose for those with college degrees and fell for those without one. But a body of recent and new research suggests that the trend need not inevitably continue.

As many as 30 million American workers without four-year college degrees have the skills to realistically move into new jobs that pay on average 70 percent more than their current ones. That estimate comes from a collaboration of academic, nonprofit, and corporate researchers who mined data on occupations and skills.

The findings point to the potential of upward mobility for millions of Americans, who might be able to climb from low-wage jobs to middle-income occupations or higher.

But the research also shows the challenge that the workers face: They currently experience less income mobility than those holding a college degree, which is routinely regarded as a measure of skills. That widely shared assumption, the researchers say, is deeply flawed.

“We need to rethink who is skilled, and how skills are measured and evaluated,” said Peter Q. Blair, a labor economist at Harvard, who was a member of the research team.

That doesn’t mean no one should go to college. The experience has value. That said, it often doesn’t have the kind of value we are trying to squeeze out of it. Organizations like Opportunity@Work and Rework America Business Network are trying to promote alternative approaches. Solving this problem will pay giant economic dividends. I highly recommend reading the data at these links especially if you are looking to try to find skilled labor for your business. There is also an excellent NBER working paper. All of these will help you think outside the box in your hiring practices.

Imagine if millions of unemployed and underemployed people could have sustainable jobs that match their abilities. It would go a long way toward solving the fiscal problems I discussed last week. We would need less safety net spending and we would have more and higher-earning taxpayers. Businesses would run better and the economy grow faster. We could begin, at least, to reverse those 1970s trend changes.

Of course, we want to maintain the progress we made in the last 50 years, too. Not everything has gone wrong. Quite a bit has gone right, as I’ll discuss in next week’s letter.

Closer to Traveling, Inflation, and College Degrees

Theoretically, next week I get my second vaccine shot at the local Walgreens. The first one was a nonevent for me. Hopefully the second will be as well. I am looking forward to beginning to travel after the end of the Strategic Investment Conference (May 5–15). This is simply going to be the best conference we’ve ever done. You really should register. Click here to do it now.

The website I mentioned above also had this quaint list of prices from 1971. Just glancing through it brought back lots of memories.

My family lived in Bridgeport, Texas, on the edge of West Texas where there were no ports or bridges. There was a man-made lake. I remember going to the local grocery store with my mother where she would buy what was on sale. I remember there would always be a few low-cost items to draw people into the store. Three pounds of hamburger for a dollar (although I can assure you the fat content wasn’t the 80 to 90% we get today). Mother would add oatmeal to make it “stretch.” Three dozen eggs for a dollar. Milk was under one dollar a gallon. On annual summer vacations to Aberdeen, Mississippi (near Tupelo) we bought gas for $0.17 a gallon in East Texas. Tuition, room, and board for Rice University was about $3,000 a year. I was lucky enough to have a full tuition ride and loans for the room and board at 3%.

I will readily admit that while Rice was a fabulous experience, I don’t use my degree today (let alone my Master of Divinity from Southwestern Baptist Theological Seminary). Tammi Cole, my executive assistant/financial officer/scheduler/boss, has a chemistry degree. She was a bench chemist for a while before she started her own business that had nothing to do with chemistry before she moved to Texas. My daughter introduced us when I was looking for help. I can guarantee you that whatever she does for me doesn’t require chemistry knowledge. (Enormous amounts of patience, yes.) My wife Shane has her own technical degrees, and she needs even more patience. I am not sure how you put sainthood on a job and/or marriage skill qualification.

And with that, I will hit the send button. You have a great week.

Your watching those inflation numbers analyst,

No comments:

Post a Comment