Falling Dominoes

As investors, we have to consider both what will happen and when it will happen. Long-term benefits won’t matter if short-term risks take you out of the game first. But taking steps to endure the short-term can help you stay around long enough to reap bigger rewards. So let’s consider the near future, then come back to the longer-range outlook.

Property developer Evergrande is the top-of-mind concern right now. Its business risks are largely confined to China; the fear is more about possible financial contagion, which could extend outside China to foreign investors and lenders. Non-Chinese debt is around $20 billion and will likely be written off. While painful to the institutions involved, the debt is manageable.

How might a contagion unfold? Here’s one scenario, outlined by my friends at The London Brief, in which Evergrande is the first domino of something worse.

Domino 2: Companies Similar to Evergrande. A significant number of companies are borrowing above 20% rates and can no longer fund from the dollar funding market. These companies can either default, they can try to sell assets, they can go to government banks to borrow money (but this route is currently closed until January) or they can go to the government. Today there are 35 “significant” companies, as per the strategist’s definition, and 13 are saying in the dollar funding market that they should not be refinanced. This is like the sub-prime equivalent; one has gone down, and the others are feeling the knock-on effect. These companies are 12.5% of the current market cap of the property sector. The amount of market cap that has been lost is $250 billion and including Evergrande is $500 billion to give some scale of numbers.

Sidebar: In the late 1970s I borrowed money at 18% to buy literal train carloads of paper. I could afford it because paper costs were rising faster than 18% and there were actual shortages. The only way to ensure I had paper for my publishing business was to store well in advance. When property developers are borrowing money at 20% and inflation is much less than 5% that tends to indicate the housing markets are overheated.

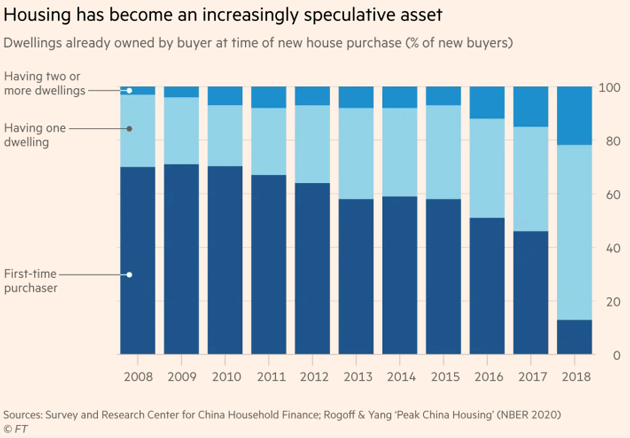

Note below that prior to the Great Recession, first-time homebuyers were roughly 70% of the Chinese market. Today it looks like 15%. Now 85% of homes are bought by people who already have one or more homes. Just like Dave Portnoy, they believe that home prices can only go in one direction: UP!!! This is rampant speculation. and while it is not subprime in the sense that these people are actually investing their savings in the second property, it is speculation nonetheless. Unless the Chinese government changes its current policy, there is going to be a serious revaluation of home prices in China, as many of these homes are empty and are out of the price range for new homebuyers.

Source: Financial Times

Domino 3: Minsheng Bank. In 2008, Bear Stearns imploded due to subprime debt. Citigroup is watching Minsheng Bank, which has lost over half of its market cap over the last few months. It is currently modelling a 20% probability of default. It could create contagion effects within the banking system.

Sidebar: We think of Evergrande as a large company. It is dwarfed by the size of Chinese banks, many of which have large loans to the real estate market as a percentage of their assets. Thus, we come to the next Domino.

Domino 4: Small Banks. There are numerous banks in China that are very similar to Northern Rock, a small bank in the UK which imploded due to its exposure to subprime debt and a balance sheet that was wrong-sized. These banks have low transparency but create exposure to larger banks and insurers. If more property developers go supernova these banks are vulnerable.

Domino 5: Ping An. This is a private insurer with a lot of problems. They own a property company called China Fortune Land. 5% of the investment portfolio is leveraged 10X. The CEO and company are under regulatory investigations. They issued wealth management products for Hong Kong tech shares. These have been sold to millions of people across the investor base of Ping An. They could see their savings wiped out and China may force Ping An to make them whole. Ping An is systemically important. The dollar bonds only widened out 40 bps last week, but it shows the market knows there is a problem. [There is never just one cockroach.]

Domino 6: The Equity Market. There are $300 billion worth of margin loans. If an insurer like Ping An went into stress, there could be more share selling on other banks creating a cascading impact that triggers margin calls.

Domino 7: Big Banks. ICBC and other systemic banks interface with international markets. Their equity prices could plummet and their CDS [Credit Default Swaps] could widen. Regulators and the banks have been assessing their risk exposures optimistically much like Morgan Stanley and other large US banks did during the subprime crisis.

Domino 8: The Credit Market. If China bank CDS blows out everything else blows out too and credit contracts dramatically. With $50 trillion of bank assets, that’s a lot of contraction.

Domino 9: The RMB Breaks. Chinese banks would have to go on a worldwide hunt for dollars, which would lead to pressure on RMB and volatility and potentially force China to break its peg.

Domino 10: The Crisis Goes Global. European, Korean, and Indian banks with yuan exposure could collapse and start to create an international contagion impact.

This is an extreme scenario which the authors don’t believe will happen. It would not be in Beijing’s interest to let events progress that far. But it’s also unclear at what point the Chinese government would intervene. That introduces uncertainty that could get out of control. This week another developer, Fantasia Holdings, defaulted on $206 million in dollar-denominated bonds—a small drop in the bucket, but more could follow.

Again, I think China will muddle through this immediate problem, but the risks are high enough to justify some preparation. Nor is financial contagion the only risk. Dave Rosenberg thinks Evergrande could set off a global recession.

No comments:

Post a Comment