Hello. Today we look at the Chinese economy’s similarities to 1980s Japan, the latest round of Latin-American interest-rate hikes, and what history shows about data when a US recession strikes.

1980s Redux? |

Nine years ago, economists at JPMorgan Chase economists compared and contrasted China’s swelling credit risks with what happened in Japan in the 1980s, on the eve of the bursting of that nation’s epic bubble.

The conclusion: China was more like Japan in the 1970s, with low household debt and plenty of scope still for urbanization and capacity for decent 6% to 7% growth. (It has averaged a little over 6% since that report.)

Fast forward to this week, and the JPMorgan team did another check-in.

This time, things aren’t looking quite so rosy.

“The worrisome news is that China has become increasingly similar to Japan in the late 1980s,” economists led by Zhu Haibin wrote in a note Thursday.

Among reasons for concern:

- China’s household debt surged to 62% of GDP last year from 28% a decade before. That compares with Japan's experience of climbing to over 60% in 1989 from about 26% in 1971

- China's corporate debt has remained high, at around 160% of GDP — above the 145% peak in Japan in the mid-1990s

- China’s demographics are changing even faster than Japan’s, with population growth stepping down and an ageing problem that’s bigger than Japan’s at a similar development stage

There remain some big differences, however. Beijing has much greater oversight of the housing market through administrative controls than Tokyo did. Its financial system remains dominated by the state sector. And its capital account is largely closed, leaving Chinese households with fewer options than Japanese ones had.

JPMorgan’s outlook doesn’t include any forecast for a crisis. But the team warns that Beijing will need to carefully manage the real-estate downturn to limit spillovers, through measures such as boosting the public housing and rental market.

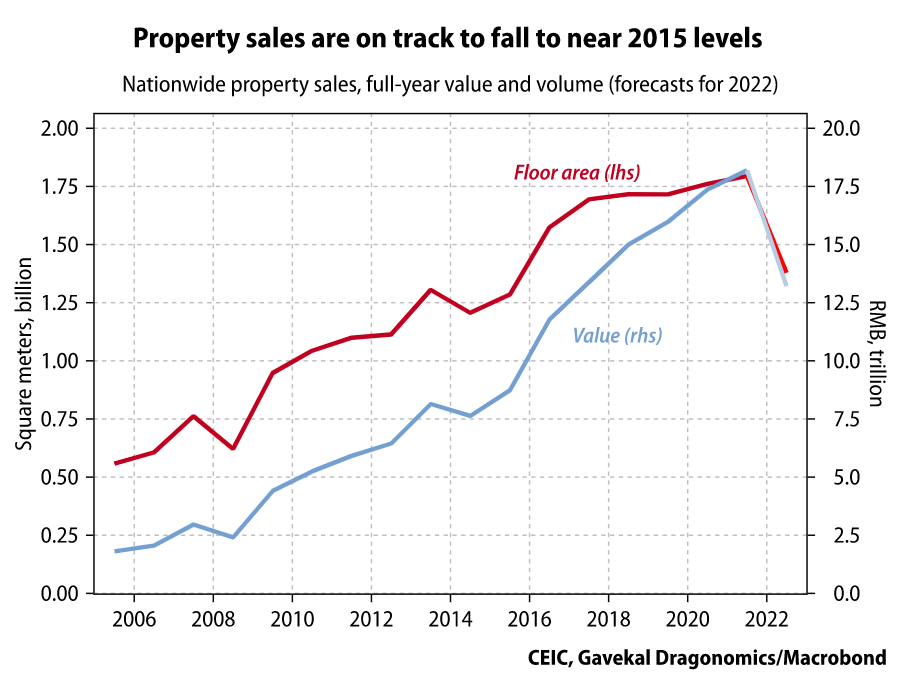

Rosealea Yao, a China property market specialist at Gavekal, isn’t so confident the administrators are providing a bottom for the downturn.

“The problems constraining both the supply and demand of housing in China are not getting resolved,” Yao wrote in a note Thursday. “In the longer term, even if property sales stabilize, the downward adjustment from the peak will still mean a lower level of construction activity and materials demand in coming years.”

No comments:

Post a Comment