I’m James Mayger, a China economy reporter in Beijing. Today we’re looking at China’s slowing economic recovery. Send us feedback and tips to ecodaily@bloomberg.net or tweet to @economics. And if you aren’t yet signed up to receive this newsletter, you can do so here. Please note: Economics Daily will be back on Wednesday, July 5, after a break for the US holiday. - Data today may show the Fed’s preferred price metrics stayed elevated in May. Underlying inflation in the euro zone accelerated.

- China’s economy lost more steam in June as manufacturing activity contracted again and other sectors failed to build momentum.

- UK living standards resume their decline in a fresh blow to Rishi Sunak.

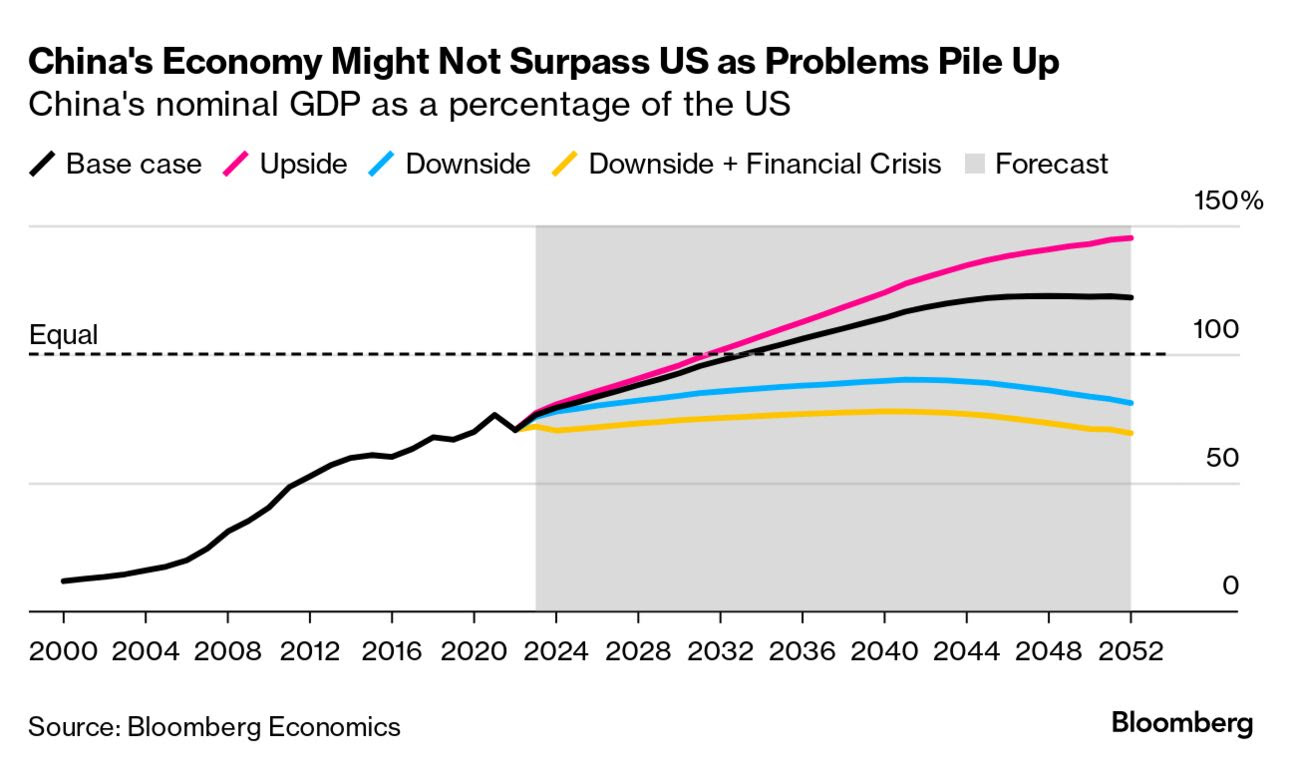

After the whole of China got Covid last December and the government finally lifted its pandemic restrictions, 2023 was meant to be the year for an economic rebound. We’re halfway through the year and instead the world’s second-largest economy is facing a confluence of problems: Sluggish consumer spending, a crisis-ridden property market, flagging exports, record youth unemployment and towering local government debt. People are becoming more pessimistic about their income and the prospects for the housing market, and debate is raging in the country on whether China is headed for a Japan-style malaise after 30 years of unprecedented economic growth. Relations with major trading partners and sources of technology such as the US, Europe, Japan or South Korea are worsening. Foreign firms in China are also increasingly wary of investing more here — partly because of concerns about the slowdown, and partly because of the rising risks from doing business in the world’s second-largest economy. Altogether, the dynamics threaten not only to lead to disappointing growth this year, but also to thwart the Chinese economy’s momentum to surpass that of the US. “A few years ago, it was difficult to imagine China not rapidly overtaking the US as the world’s biggest economy,” said Tom Orlik, chief economist for Bloomberg Economics. “Now, that geopolitical moment will almost certainly be delayed, and it’s possible to imagine scenarios where it doesn’t happen at all.”

China’s $18 trillion economy is struggling across a range of sectors. In the debt-strapped southwestern province of Guizhou, officials are seeking bailouts from Beijing. In the manufacturing hub of Yiwu in coastal Zhejiang province, small businesses say sales are down substantially from 2021 levels. Over in the city of Hangzhou — the home of e-commerce giant Alibaba — a government regulatory crackdown on the tech sector and tens of thousands of layoffs are now affecting the property market. China’s official growth target of around 5%, which was deemed unambitious when it was announced in March, now looks more realistic. Goldman Sachs in June cut its forecast for China’s growth this year to 5.4% from 6%. That doesn’t look too shabby at first glance, given the world economy is expected to grow a meager 2.8%. The reality, though, is that since China was still under Covid rules in 2022, a low base for comparison is flattering the headline. Netting out the base effect, growth for 2023 will look closer to 3% — less than half the pre-pandemic average, Bloomberg Economics said. President Xi Jinping’s government doesn’t have great options to fix things. Beijing’s typical playbook of using large-scale stimulus to boost demand has led to massive oversupply in property and industry, and surging debt levels among local governments. Those fundamental imbalances have prompted a number of connected and influential economists to warn that there’s no big bang of stimulus on the horizon.  An aerial view of a stalled housing construction project in Zunyi, China. Photographer: Qilai Shen Those hoping for are massive stimulus to shore up the weakening economic recovery are likely to be disappointed, Zhu Min, a former deputy managing director of the International Monetary Fund, said this week. “There are a lot of expectations on the Chinese government to have more stimulus policies. I don’t think this is real.” And the changes in the economy mean that people should be prepared for slower growth, according to Keyu Jin, an economics professor at the London School of Economics and Political Science who wrote The New China Playbook: Beyond Socialism and Capitalism. “We’re caught in a kind of vicious circle in the sense that you need a massive stimulus to create a little moderate impact,” she said this week. “We have to be prepared for slower growth in the future because China is really in transition right now from industrialization to innovation-based growth.”

|

No comments:

Post a Comment