And finally, here's what Joe’s interested in this morning |

I'm sure that economists are going to be writing papers for decades to come about what caused the huge inflation spike in 2021 and 2022. Fiscal policy, monetary policy, supply chain snarls, general societal disruption... an intelligent person can find a way to implicate any of these factors.

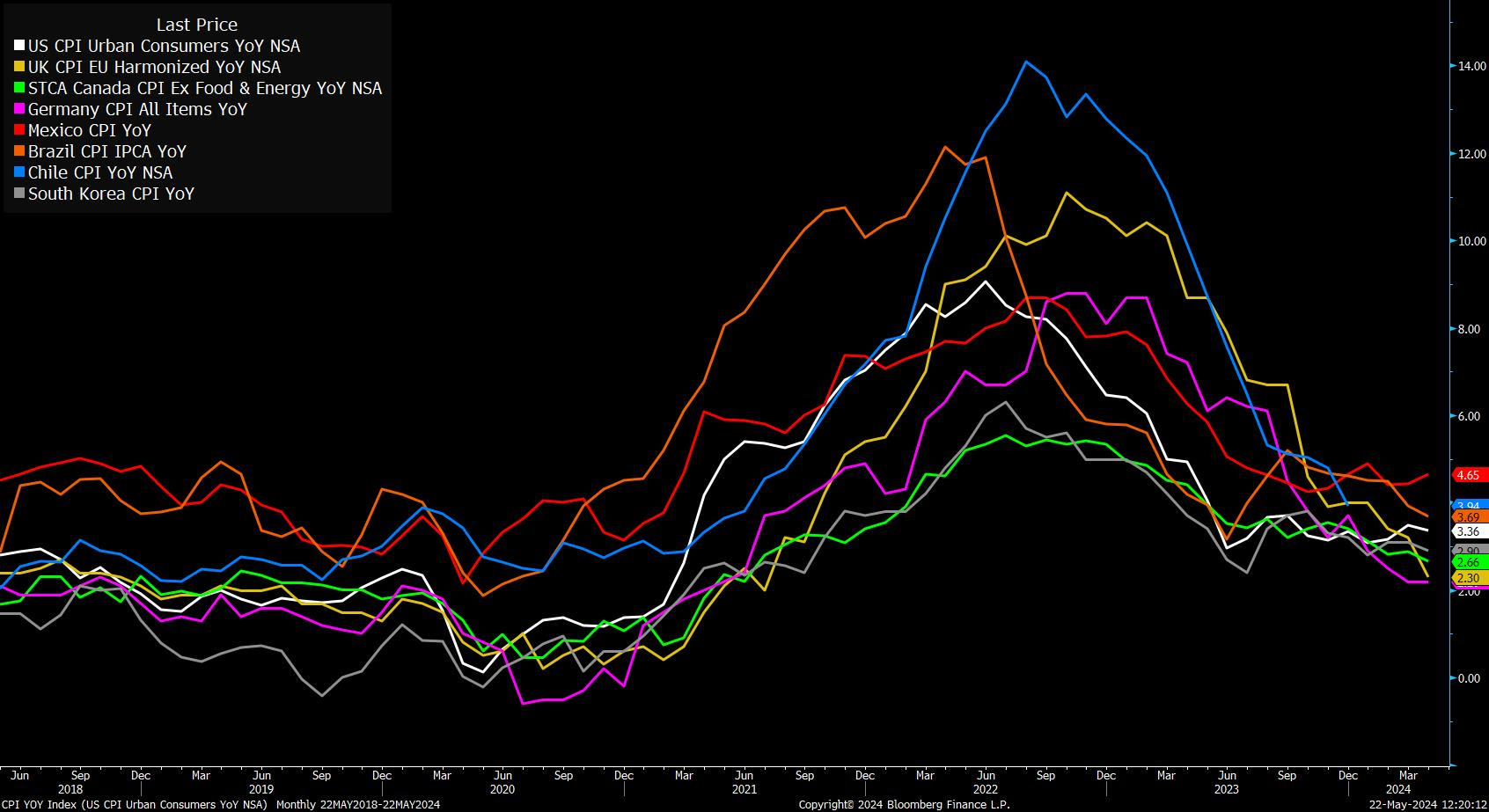

That being said, an important thing to bear in mind is that inflation truly has been global in nature.

So if you're going to point to any specific policy choice, you have to argue one of two things. Either the policy was more-or-less implemented in every country around the world. Or if it's specifically a US policy decision, then the impact of US policy and US demand is so great, that it creates ripples all around the world. The latter of course is totally plausible.

Another thing to note is that not only was inflation was a global phenomenon, the disinflation of the past year is similarly widespread.

Here's a chart with a bunch of different CPI measures from around the world. It's kind of a random list, and some measures don't map perfectly to others. But the general point is that the lines are, for the most part, going down. There are some outliers —the US in white has obviously gone sideways for awhile and Mexican inflation has bounced since last fall. But, for the most part, the lines are going down.

So if you accept the premise that there's some common factor driving inflation (and it would be weird if there weren't, since the lines all basically peaked around the same time) then it also makes sense to look at measures across a bunch of different countries to see it ebbing, as inflation (at least so far) continues to cool.

Follow Bloomberg's Joe Weisenthal on X @TheStalwart

No comments:

Post a Comment